What Moving Averages are?

The moving averages are trend indicators. They have different timeframes, short-term, medium term and long term. As their name suggests there are an average of the last prices. So it helps to smooth the evolution of the price and its extremes. These indicators are widely used by traders because their use is simple.

Differents types of moving averages

There are 3 types of moving averages, arithmetic moving average, exponential and weighted. If the calculation method differs, all are averages of prices. Here an introduction of the 3:

– The arithmetic moving average (AMA): This is the most common because it is the easiest to calculate. Simply add the all prices of a period and divide it by the number of days. Thus, if the moving average is the AMA5 of December 10, we will need the closing price of 10th December and the previous 4 days.

– The exponential moving average (EMA): Just as the AMA, it is an average of prices except that it seeks to give greater importance to the most recent prices. Prices are weighted based on a percentage. Newest is the p rice, more important is the percentage. Everyone can choose the percentage of weight they want, for example 80%. Thus, in N, the price is taken fully, but for n-1, in the calculation we will take 80% of the price (for example: 10USD*80% or 8$) and so on. N-2, we will take 80% of80 %….

– The weighted moving average (WMA): Its objective is the same as EMA, give more importance to recent prices. The method of weighting is just different. Here a coefficient is applied. On a MMP5, the price for N will have a coefficient of 5 (5 * the price in N). N-1, the price will have a coefficient of 4 (4 * course) ..

Which Moving Average to use?

EMA and WMA give more importance to recent prices. They are therefore more likely to give you the short term trend because they move quickly. But this means that they can give false signals to buy or sell. Its aim is to give the earliest possible time to enter a trade with quick signals they give.

The AMA’s main advantage is to eliminate the majority of false signals but on the other hand the short term trend appear you less quickly. However, the current trend will be clearly visible.

The more you choose a moving average calculated on a small number of periods, the more you’ll get signals (and hence false signals) due to the fact that the moving average will stick to the price as shown in the chart below.

It is important to note that this is not the price that stick or follow the moving average but the reverse.

Therefore, it’s up to you to choose your best one..

How to interpret Moving Averages?

You doubt that if moving averages are bullish, we’re in a bull market and whether they are bearish, we are in a bear market. We are in the presence of a trend.The market is in trend. The moving averages are used to take a position on the market because they deliver buy or sell signals in two forms:

– Depending on the price, the moving average is compared to the price.

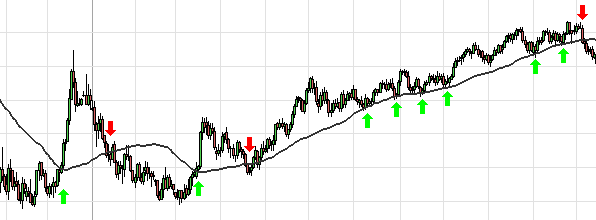

A buy signal is given when the price cross over the moving averages on a rise. The strength of the signal is function of the moving average. More moving average is long term, the stronger the buy signal is strong. Another factor is also involved. If the moving average acted as a resistance before, to get over it increase the strength of the signal. At least, a rebound on the moving average can also be considered as a buy signal.

A sell signal is given when the price cross over the moving averages on a drop. The strength of the signal is function of the moving average. More moving average is long term, the stronger the sell signal is strong. Another factor is also involved. If the moving average acted as a support before, to get through it increase the strength of the signal. At least, a rebound on the moving average can also be consiedered as a sell signal.

Here’s a chart showing various buy and sell signals :

– Depending on another moving average, moving average is compared to another moving average.

If a short-term moving average crosses on a rise a long term moving average, this gives a strong buy signal on the short term. Thereafter, more space there is between the two moving averages, more bullish is the trend.

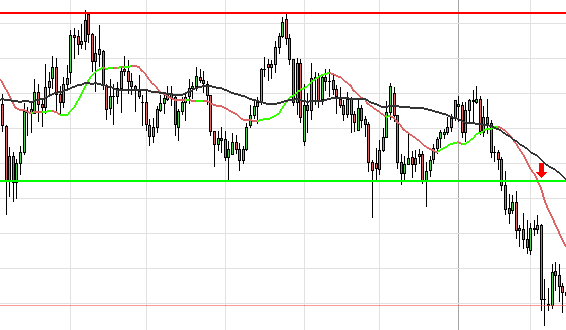

If a short-term moving average crosses on a drop a long term moving average, this gives a strong sell signal on the short term. Thereafter, more space there is between the two moving averages, more bearish is the trend.

Here is a chart illustrating the crossing of moving averages :

Moving averages can also be flat, it means that the market is undecided and that the market is moving in a range. The buy or sell signal is given by the intersection of the moving average with one of the two bands of the range. Several signs show that we are witnessing a phase of indecision:

– Moving averages do not space after the crossing

– Multiple crossing of moving averages

– Fast change of moving averages after the crossing.

The chart below shows a phase of indecision. The breakout of the lower band of the range by moving average gives us the sell signal:

You know almost everything about moving averages. A final piece of advice seems necessary. In practice, when a buying or selling signal is given by moving averages, the crossing is often followed by a pull back. This means that the price or the moving average will get back to the moving average or the price crossed, and thereafter make a reversal in the side of the signal.