As you might know, I’m mainly a reversal trader. I use other strategies as well, but my bread and butter setups revolve around swing trading reversals.

This article is about an entry trigger I often use for my reversal trades. I describe it in my trading plan as pin and drive, which basically means that if I see a pin bar followed by a drive in the opposite direction (a momentum candle, if you wish) AND some additional conditions are fulfilled, I have found that it is often a good trigger to enter a reversal.

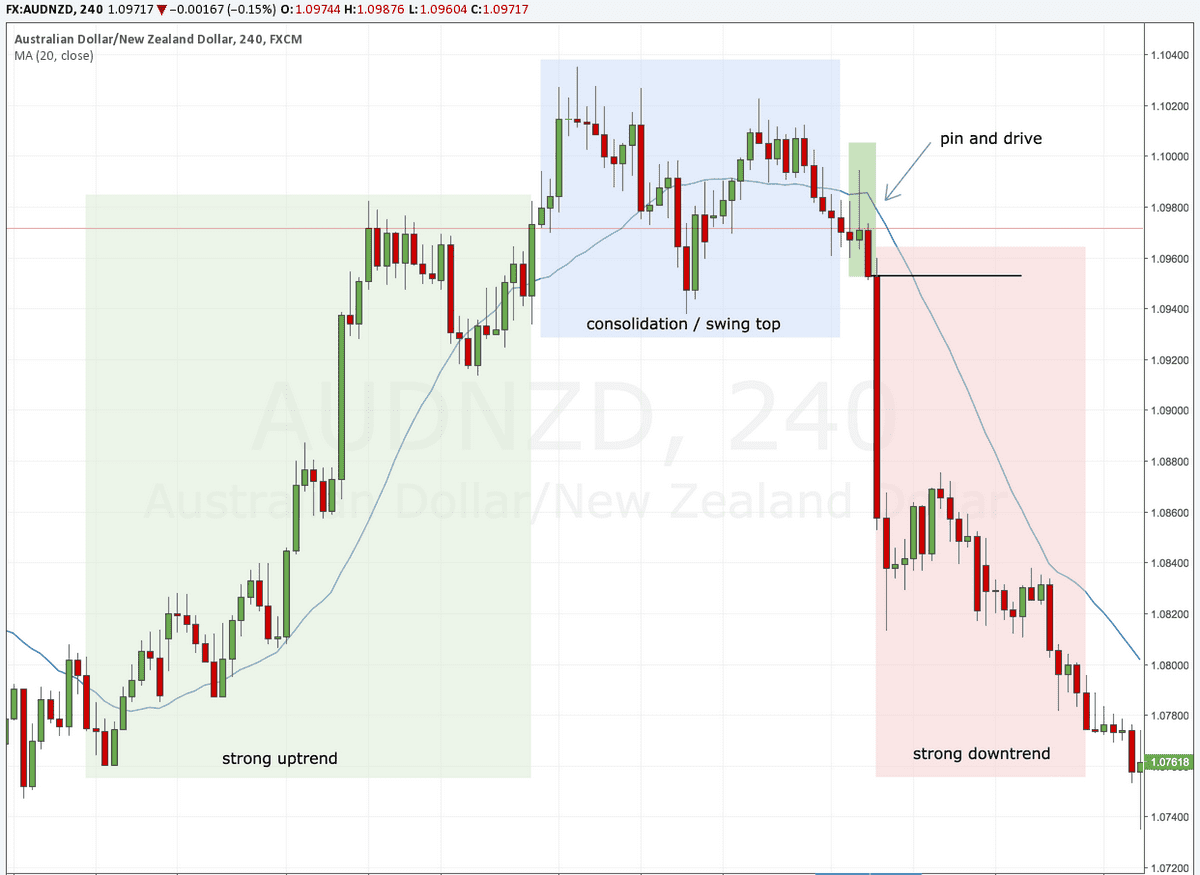

But first, let’s make it clear what I mean with a chart:

Now, just for a moment, have a look at your own charts.

You’ll see that it happens quite often, just before the strong first part of the new trend. On this chart alone, it wasn’t hard to find it 3 times. Let’s go over the examples.

Pin and drive examples

On the previous chart, we can see 3 examples of the pin and drive. In the first one, we can see a market top with a clearly defined upper resistance that hasn’t been broken, although price made about 5 attempts at breaking it.

Price moved lower eventually, making one final attempt at the level. This is when the pin bar formed. A strong bearish momentum continued and after the drive candle, I would get in the trade with plenty of downside potential.

The second example is a 3 bar pin and drive pattern with a similar idea. As the downtrend went on, we could see a shift from strong bearish bars to more and more bullish bars that encompassed the bearish ones.

Price initially broke the moving average, but this wouldn’t have been a strong enough signal for me. However, when I saw the pin bar, followed by the drive candle, that signalled the real shift in momentum for me. Perfect place to get in and ride the trend.

Finally, this reversal was a bit more challenging. We could see some pin and drive patterns during the market top, but none of them really showed momentum, indicated by the longer lower wicks of the drive candles.

Price made an attempt at the lows but couldn’t hold the levels. Eventually, we could see a much stronger pattern emerging, with strong downwards momentum. Entering here would have been a good moment to ride the trend down.

Requirements The Strategy

But before we continue, I want to share my preconditions for actually taking this pattern. Without those, I won’t really look at this pattern since it has to happen at the right place and at the right time.

First,

- I want to see a nice, multi-wave trend first

- I want to see some market top or bottom pattern. H&S, double tops/bottoms, etc

- I usually wait for a higher high (in a bullish reversal) or lower low (in a bearish reversal). If the pin and drive pattern itself makes this HH/LL, that’s fine too

- Either the pin bar or the drive candle has to cross the 20-period simple moving average convincingly. The 20SMA for me is both to see where price is in relation to the overall trend and also an entry filter. If it barely crosses the moving average, I will usually wait for additional confirmation.

- Every other reversal signal (like RSI divergence, Fibonacci lines, Bollinger band spikes, pivot points) adds extra confluence.

Rejection Price

But why does this work? Why should you trust this?

The pin and drive pattern is so powerful since it signifies a strong rejection and exhaustion of one side of the market. The pin bar shows that market participants have tried to make one last run for the other direction, failed and got rejected hard (hence the pin bar). Not only that, the drive candle shows continued momentum in the opposite direction, indicating that one side of the market is firmly in control.

In the context of reversal trading, it is a pattern that I will want to see happen in the second half of a reversal. Let’s make this more clear with an example of a trade I took a while ago.

In the example above, there are 3 well-defined market phases (you could define more, but for the sake of this example I’ll keep it at 3). First, we have a strong uptrend (green zone). Price is making strong upwards waves and there are little or small retracements. However, at the end of the green zone, this starts to change.

We then enter a consolidation zone. This signifies that the bulls have trouble to keep the uptrend going and the bears are stepping in. This consolidation zone is identified by much more bearish candlesticks, which are stronger too. Price then fails to make higher highs, creating a double top pattern.

It’s only at this stage, well over the “midway point” of this reversal, that I’ll start looking for the pin and drive pattern. At this point, the market is showing the shift in direction. This is often where the pin and drive pattern will present itself the strongest. The pin bar then exemplifies one last push by the bulls, trying to get the price higher. This is sharply rejected and the drive candle means that there is a continued momentum to the downside.

If you were to get in at the close of the drive candle, you would’ve been able to ride the trend down very easily.

Variations of the pattern

As the name indicates, this is usually a 2 bar pattern. However, my rules are a bit more flexible in that 3 other variations are acceptable. Let’s go over them:

3 or 4 bar pin and drive

Occasionally, there will be a short pause between the pin bar and the drive candle. This can have multiple reasons, such as the market taking a breather, the pattern just happening around the candle close or just when the pattern happens when the major markets are closed and there is lower trading volume.

As long as you can clearly see the momentum picking up again, this is usually not a problem and I also consider these to be valid signals. A bit more care could be given when this happens because this can also mean that the market isn’t ready to reverse just yet.

The size and form of the “in between” bars is also important. Ideally, these will be smaller bars without too much pushes in the opposite direction of the trade you might take. It takes some practice to be able to detect which bar patterns look good and which don’t, but it’s something to take into consideration.

One bar pin and drive

On the other hand, it’s also possible that the entire rejection and drive happens in just one bar. This signal is as valid as any pin and drive pattern and can absolutely be traded. It usually looks like a long bar where one side has a long wick and the opposite side closes very strongly to the reversal side.

It’s a bit less common since this means that a lot happens in just one candle. Important is that the candle closes close to or at the absolute high (for a bullish candle) or low (for a bearish candle) of the bar. There should be little or no wick visible on that side.

Pin and drive with 2-bar pin bar

A final variation is when the pin bar is a bullish or bearish two-bar reversal. This means that there was a similar rejection of a price point. When you would look on the higher time frame, this will often show as a pin bar, since in essence, it’s the same pattern but played out over 2 bars instead of one.

Again, we can see a strong drive afterwards, breaking local lows and signalling a new price direction. Here’s an example:

Size and location of the drive candle

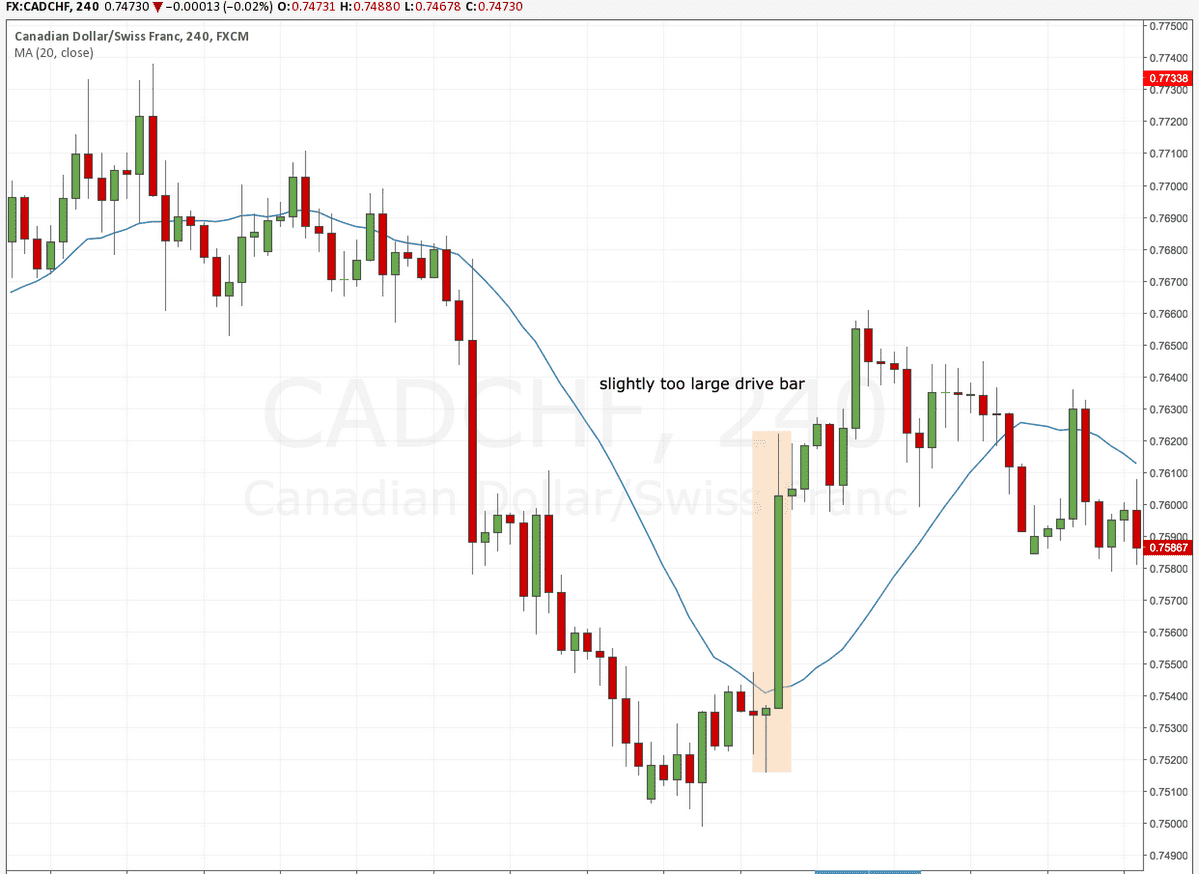

The size and location of the drive candle are other things to take into consideration. As the examples show, not every drive candle is as large as the others and it also often closes at different places in relation to the moving average.

As with many entry triggers, a large drive candle signals momentum in a specific direction, which is good. However, a too large candle might mean that the opportunity to get in has passed and the risk to reward of the potential trade is too low to make it worth it. If the drive candle has moved away too far from the moving average, it can also mean that the opportunity is largely gone.

The drive candle in the example above already covered about half of the previous trend. Additionally, it has already moved quite far from the moving average, which we might use as a guide for our new trend. Remember, you can always skip a trade and other opportunities will always present themselves.

Stop loss and take profit

I will usually put the stop loss above or below the drive candle. However, I will sometimes deviate from this rule if:

- the drive candle is quite large. In that case, I might set my stop loss a bit above half the size or a little bit above the 61.2% retracement of the candle.

- there is a strong structure close to my stop loss. In that case, I will respect that structure and put my stops slightly above or below it.

As for the take profit, I will look at previous support and resistance. One thing I keep into account is that my R:R has to be at least 1:2 in order for me to take the trade. If the potential reward is too small, I will just skip the trade (and definitely not force the trade or make the stop loss smaller!).

You could, however, also apply your own rules here. It can be perfectly valid to exit the trade using a dynamic stop if the price crosses and closes above/below the moving average. In some cases, you’ll be able to catch a large runner this way but in other cases, you’ll cut a longer trend short. Your trading journal should dictate here what to do.

Conclusion

Before I leave you with this, it’s important to note that this isn’t a complete trading system. I’ve explained my requirements for even considering to trade this pattern, where it should happen, what to look for and more. This is an entry trigger; a final “go” signal from the market to actually take a position or not. This is very different from a trading system or even what constitutes a trading setup.

What you can take from this, however, is a way to enter the market with a higher probability of success, once all your trade conditions have been fulfilled. Something to add to your trading toolbox, whether you use it as an entry trigger or just additional confirmation in your existing reversal trading strategy.

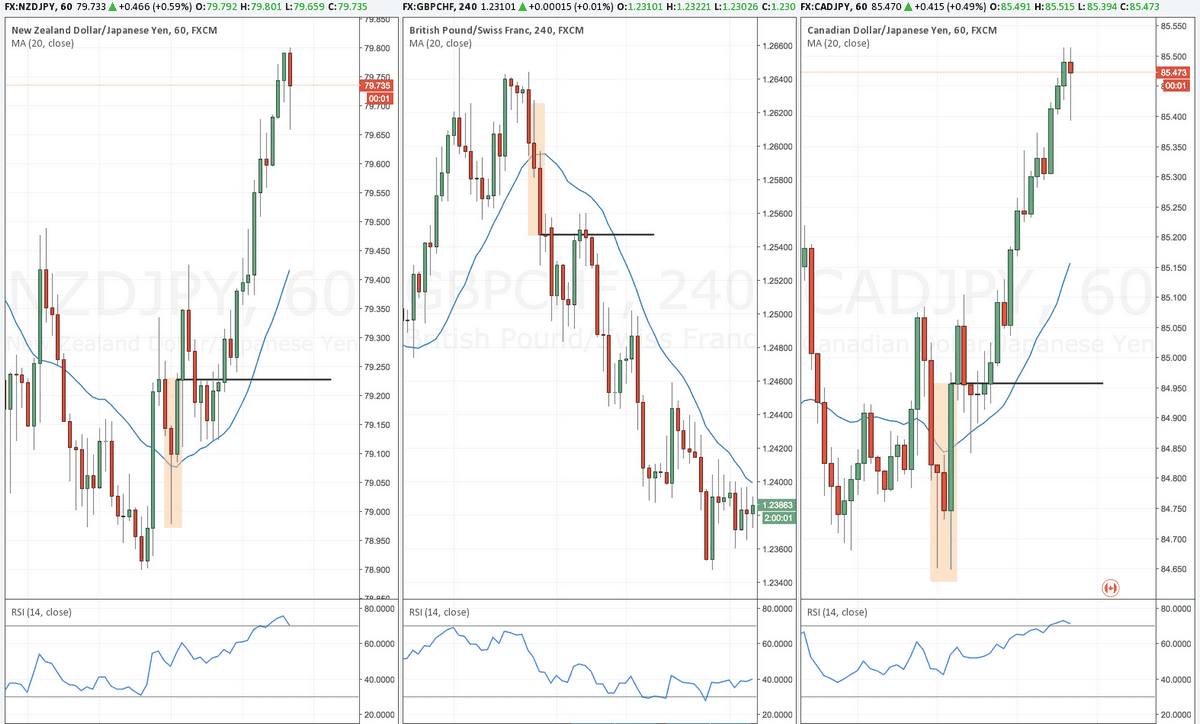

Let’s close off with some additional examples. Now, it’s up to you to find the pin and drive pattern on your charts. Good luck trading!

Have you found this pattern useful? Let me know in the comments!