What does the “Spread” is?

The Forex spread is the difference between the bid (offer) and ask (demand). In other words, it is the gap between bid and ask price offered by a broker. The spread allows the broker be remunerated for transactions that its customers are making on its trading platform.

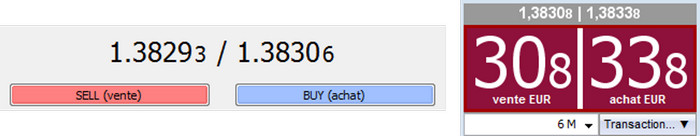

Here are examples of quotes that you can find on some trading platforms:

The bid price (left side) is the price at which you can sell the base currency of the pair. This is the price at which the market maker is willing to buy the base currency. Conversely, the ask price (right side) is the price at which you can buy the base currency on the pair. This is the price at which the market maker is willing to sell the base currency.

The quote on the left side above shows that the EUR / USD quotes 1.38293/1.38306. This means that at this moment, you can buy the euro at 1.38306 and sell the euro at 1.38293. The spread is calculated as follows: 1.38306 – 1.38293 = 1.3 pips. On the right side quotes above, the spread is more important: 1.38338 – 1.38308 = 3 pips.

To you therefore to compare the spreads of each broker based on parity that you usually trade to find the most advantageous broker. Be careful, the spread is not the only matter, you must also check the execution delays on the platform of the broker. Indeed, some offers very tighten spreads, but you are never executed at the price you want (relisting, slippage … or worse, you may not be executed)

What are the factors that affect the spread?

The spread will be fixed or variable depending on the Forex brokers. Moreover, according to the pair traded, the spread will be more or less big. This is based on the liquidity and volatility. More a pair is liquid, more the spread will be tight. The EUR / USD as the world’s most traded and therefore most liquid pair is the pair with the lowest spreads. However, if you trade an exotic currency, liquidity is low in these currencies and so the spread will be much higher.

As I said, the spread is also a function of volatility. More a pair is volatile, more the spread will be large. Indeed, on a volatile pair, changes in pips will be important throughout the day. So if you trade on GBP / CHF, it will be easy to take advantage of a movement of 50 pips and so the spread will be larger than on the EUR / USD for example. On the EUR / USD, capturing a movement of 50 pips is more complicated because the pair is much less volatile.

Distinction between variables spreads and fixed spreads

Fixed spreads have the advantage that we always know the spread we are going to pay when you put an order. At any time of the day, the spread will be the same regardless of market conditions. For example, during a major economic announcement as U.S. unemployment, spreads will remain fixed.

Conversely, variables spreads are constantly changing throughout the day depending on market conditions. More the volatility is high and more liquidity is low, more the spread will be large. During an economic announcement, spreads will increase significantly (due to the increase of the volatility) and we could see spreads of 3 to 4 higher than normal. In return, in normal market conditions (that is to say outside economic event or announcement), the spreads are often lower than fixed spreads.

What commissions are charged on a trade?

The spread is only paid once, when the position is taken. The explanation is simple, the eur / usd quotes 1.3900 – 1.3902, 1.3902. So you buy at 1.3902 and if you sell immediately, you do so at 1.3900. The spread has been paid only once.

To this may be add additional fees on transaction volume. It is often the case with brokers who offer variable spreads. These commissions vary according to each broker. You can find as example a commission of 40USD per million traded. In other words, you can add 0.4 pips to the spread display by the broker to get the real price you’re going to pay. All brokers in spreads variables do not apply such commissions.