Every day, you spend hours looking for the best setups. Analysing the markets, looking for price action patterns, cross-checking fundamental news, drawing support and resistance on the charts.

Finally, you find the perfect trade. It’s a beautiful, triple-A setup! At exactly the right time, you enter an order.

But what happens when you’re in a trade? Is your work done?

Of course not! It has just started! Trade management and exit strategies are an overlooked part of trading, but so important. It’s something my Trade Advisor students and I pay a lot of attention to because I believe it’s even more important than your entry.

Exits can make or break your trading strategy.

Where we go wrong

In fact, I’m not the only one who thinks so. Research conducted by Chuck LeBeau and Van K. Tharp (who wrote the excellent book called Trade Your Way to Financial Freedom) shows that exits have more impact on the results of a system than any other factor, including money management.

Let’s say you run an experiment where over a period of one month, you give 30 orders to two traders. Trader one is inexperienced and trader two has been trading profitably for years.

Regardless of what the market might do, there’s a fair chance that trader one will end up with a net loss and trader two will end up with a net win, even though they both started out with the same trades! You only need to look at the Turtle Traders experiment to know that given the same conditions, not all traders will manage their trades the same way.

Common causes

Trading performance depends on trade management and knowing how to maximize take profit and limit losses. But there are so many reasons why that’s not as easy as it sounds! Here are some examples of common reasons traders lose out.

Seeing the price move in your direction, only to see it reverse just before it hits your take profit:

Closing the position at a mediocre price level because there is a price retracement and the trader gets cold feet:

And there are plenty more scenarios that will negatively affect the expectancy of your trading system:

- Setting the take profit level closer to the open price half-way in the trade.

- Moving a stop loss to break-even too quickly.

- Close the position too early, never allowing the take profit to get hit.

- Not seeing the market reverse and losing unrealized profits.

The marshmallow effect

And research has shown that our behavior in these scenarios is in fact very natural. Consider this test they give to children: the children are left in a room with a single marshmallow and are told if they do not eat it they will get two. Research indicated that those that have enough emotional control to delay eating that first marshmallow have a far better chance of winning in life.

If we see a profit, our natural instinct is to grab it so it doesn’t get away. This has worked for us for thousands of years because it has proved beneficial for us in life. Trading is different though.

As a trader, we need to do the exact opposite. We need to go against our deeply engrained instincts and habits if we want to be profitable. We need to leave that one marshmallow on the table so it might turn into multiple marshmallows. Delayed gratification over instant gratification. Patience.

I’m calling this the marshmallow effect of trading.

Step one is to have the patience to hold on to your original trading idea. Changing your mind constantly is something losing traders do. It’s exceptionally hard to stick to our original plan, but I guarantee it will lead to better results if you do so.

The art of taking profit

Your trading idea might be worth a million dollars, but if you fail to set the right take profit levels and manage your exit strategy properly, you might end up with a loss.

The reason is that the exit of a trade, rather than being just a level or a single action, presents to you – the trader – a multitude of different scenario’s. It can go your way and turn around just before it’s hit. The market can rush through it in an instant. Price can come very close to hitting your stop loss and then, after a long and unnerving grind, hit your take profit anyway. You might take off half of the position early and let profits run for the other half. Or price can range for what seems to be eternity and then breakout to hit the TP. I can easily come up with 20 more scenario’s of what might happen.

Exit strategies are not easy. The strongest emotions are often linked to taking profits, or put differently: not wanting to lose unrealized profits. The fear of losing out. Giving it back to the market. Do you feel greedy or fearful when price moves in your direction?

Consistency is key

But one thing is for sure: the market doesn’t care for you. What’s more: you don’t have any control over what the market does. What you do have control over however, is how you respond to what happens.

How you respond to the market is what defines you as a trader.

If you see price turning against you, do you take profit early? Do you jump out of your trade at the worst moments – if you’re in a loss? Or have you learned through experience and back-testing that retracements happen and hang in there? Maybe you keep a trading journal where past trades have made it clear for you that 8 out of 10 times, price would have hit your take profit anyway.

The most important thing to take away is that you should be consistent in how you deal with the scenarios above. The answer to each and every question should be in your trading plan. Only if and when you’re consistent in your trading, you can start measuring your trading performance accurately. And only by measuring, you will be able to improve yourself and your trading performance.

Exit strategies

The trader’s maxim says: cut your losses short and let profits run.

But is it really that black and white? I prefer a more nuanced view to profit taking and while I absolutely agree with trying to minimize your losses and maximize your profits, there are multiple ways to do so. Let’s go over a couple of strategies that can improve your profitability considerably.

The first two might even be quite unusual, but I promise they will help you become a more profitable and consistent trader.

1. Only use the candle close

How is this an exit strategy? Well, by not interfering with your original trade idea, you’ll likely get a better end result.

Most traders will not benefit from looking at the charts all day. Doing so results in fretting over intra-candle price movements, while the result at the candle close might look completely different. By only using the candle close, you’ll be less inclined to take impulsive decisions based on mid-candle price movements. This usually means better trade management and less meddling with your original trade idea.

The pin bar is the perfect example of this. Due to the very nature of a pin bar, a lot of traders must’ve thought at some point that price would be going completely in one direction, before sharply reversing the other way. Waiting for the candle close would give you a very different picture of the market than what was happening halfway through.

As a trader using mostly 4H charts, I only look at my charts every 4 hours. I’ll check my trading setups 4 to 5 times a day, that’s it. From the moment I started doing this, I became a better trader and as an added bonus, this leaves me a plenty of time to do other things.

2. Use price alerts

Next to only using the candle close, I’ll be setting price alerts at levels that, if the price crosses that level, I will want to be informed or manage my trades. This again focusses on reducing chart-time and therefore reducing the time I can potentially spend doubting my original trade idea.

Alerts also makes you think in advance at which levels you want to take action. These “what if” scenarios are a great way to determine in advance how you will manage your trade, which includes how you will exit your trade and where your take profit will be. Alerts are also great if you want to scale in or scale out of positions during a trade. Just set an alert at the appropriate price levels and you’re done!

I’m using TradingView alerts for this, but you can also setup price alerts for Metatrader 4 and there are plenty of other options such as the Call Levels app or websites such as AlertFX.

3. Determine the right take profit levels

In my experience, you get the best results if your take profit levels are supported by market data. What this means is that for every trade, you find relevant market structure, volatility data, chart patterns or other information that support your idea that price is likely to move to a certain level. No fixed take profit levels at random price points.

This level (minus a few pips to account for things like spread) will then be your take profit level. Using this approach accomplishes multiple things: firstly, since your take profit level is no longer a arbitrary number, it is much more likely that the price will actually move to this point to test it.

Secondly, you can determine if your R:R (risk:reward) is worth it based on levels directed by market data and structure, which makes much more sense. A trade setup might look really good, but if there’s a major support level a little bit further in the direction of you take profit, you might find that it’s not worth risking entering this trade for only 0.5 R reward.

This is how I determine my take profit levels:

Look for a pair to trade:

Find support and resistance on the chart. Often, these are not just lines but rather zones where the price has historically seen a bigger activity. This doesn’t mean that our price will always move to those levels, but price does have a tendency to retest existing support and resistance levels, as you can see on the chart:

For a buy order, place your take profit level a few pips below resistance. For a sell order, place your take profit a few pips above support. This accounts for things like spread and is generally safer than to put your stop loss on the actual level.

As you can see, I defined multiple support levels to the downside. These levels might correspond with potential take profit levels, but more often than not, I will just close my trade after the first TP level if the R:R is good enough. However, the chart illustrates where you could potentially take profit, based on the support and resistance levels defined earlier.

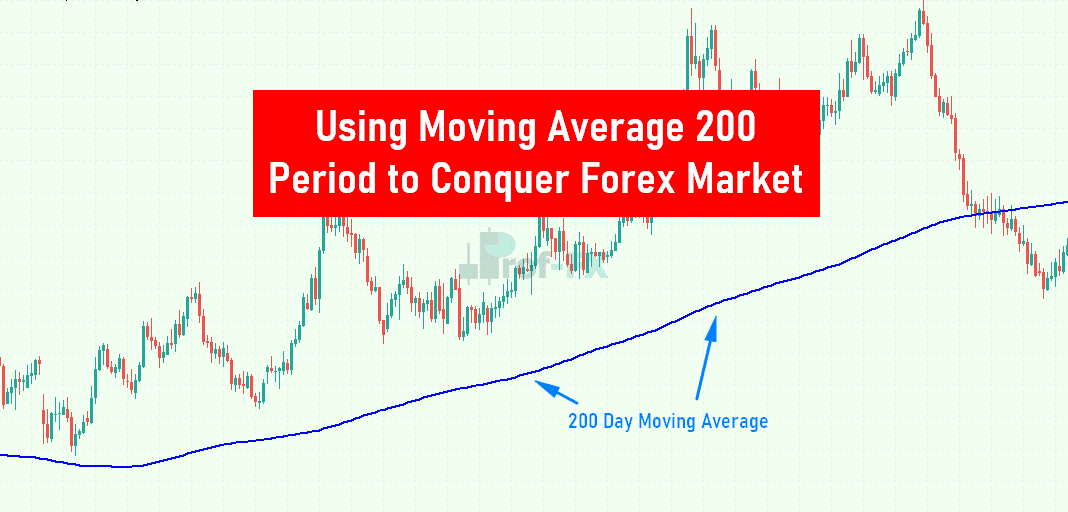

Other things I look for when determining take profit levels are things like trend lines, spikes in price activity and moving averages. However, I’ve found that usually the price will adhere the most to horizontal levels.

4. Partial and intermediate take profit

This is an advanced concept, and you should therefor not attempt this if you’re just starting out trading. Having intermediate, partial profit levels allows you to take part of your trade’s profit when price reaches a certain point.

If there’s something that will get traders feeling bad about their losses more than anything, it’s a winning trade that turns around and turns into a loser.

If you had this before, you know what I’m talking about.

This could be a good strategy if you see this happening a lot with your losing trades. You see price first moving in the right direction, only to see it reverse. If you could’ve taken partial profits at some level, you accomplish two things: first, you secure some of your winnings. Secondly: you decrease your trade size for the remaining part, which means that if your trade eventually hits stop loss, you will lose a smaller amount than before.

Of course, the opposite is also true: if price ends up continuing in your direction, there will be less left to take profit. It’s a case of security vs maximum profits.

There are multiple ways you could tackle multiple take profits. Let’s look at a few of them.

Take profit halfway

Using this method, you just take off half of the position once the price moves halfway in your direction. It’s a very straightforward exit strategy and while the likelihood of some profits are probably fairly high, your R-multiple will also be skewed since only some of your trades will hit the second profit target. A good rule of thumb is to move your stop loss to break-even once the first profit level is hit.

Even though in my example, the take profit levels are close to 50%, it definitely pays off to look if you can find support and resistance, Fibonacci levels or other market structure to increase the likelihood that your take profit levels actually get hit. It’s more important to look for confluence using these factors than to literally use 50% levels. If you find that 60% – 40% corresponds to better market structure, you should absolutely use those levels instead.

Triple scale out

This is something I first read about in Mark Douglas’s book Trading in the Zone, but is essentially what you would call “scaling out”. In the last chapters of his book, Mark talks about profit taking and how he would split up the take profit for every trade into three equal parts. Let’s say you have a 3 lot trade, then the following would happen:

- After one third, you take off 1 lot of the order size.

- After two thirds, you take off another 1 lot of the order size and at the same time, move your stop loss to break even.

- After three thirds, your full take profit has been reached.

Since you move your stop loss to break even after the second level, from there on your trade is essentially risk-free. It’s an easy way to distribute the potential profits you can take, while still leaving room for the market to move.

The 80/20 method

The 80/20 method is an adaptation of the Pareto principle, applied to trading. I first read about this on the excellent Trading Heroes website. Essentially, you still have multiple take profit levels, but once the first take profit level is hit, you take 80% of the trading position off and trail the remaining 20% to a take profit level that is much further away, but would every once in a while get hit anyway if the market moves in that direction.

The advantage over the take profit halfway method is that once the first take profit level is hit, you cash in most of your order in one go. This means that – even though the second take profit level might get hit only one in 5 times – it doesn’t affect your overall expectancy as much as it would when 50% of your position is still open. However, when that second take profit level gets hit, it usually makes up for the unrealized gains of other trades due to placing it at a level that is a lot further away from your open price. And as you know you have locked in quite some profits already, this situation provides less stress to the trader.

You need to consider using an initial take profit level that gets hit often enough to make the overall R:R of the trade worth it. Additionally, you should think about how to trail your stop efficiently in order to maximize the chances that your second take profit gets hit, while at the same time minimizing losing unrealized gains. This could be using a fixed-pip trailing stop or you could try strategies such as moving the stop loss below previous market structure or manually adjusting your stop loss based on a moving average. The best approach will depend on your own strategy, timeframe and volatility of the market you’re trading.

Conclusion

Of course, there are many more take profit strategies. But often, they can be categorized under one of the strategies we discussed today. Let’s recap what you can do today to improve your trading:

- Have the patience to stick to your original trading idea. Define up-front what would have to change in the market in order to invalidate your idea and stick to it.

- Be consistent in your trading approach. Your trading system is not a trading system if you constantly change the way you trade. Consistency is the only way to reliably measure your trading performance and roll out improvements based on hard data – not some guess.

- Use the candle close. It will save you time and relieve you from stressing over intra-candle price movements that might not result in anything anyway.

- Use price alerts. Price alerts allow you to spend less time behind the charts and force you to think in advance about which price levels are important for you to take action or be informed about.

- Have a reliable way to determine take profit levels. Use the market structure, not an arbitrary number of pips. Market structure can include things like support and resistance, Fibonacci levels, price action patterns and more.

- Experiment with multiple take profit levels. These can help you lock in some of those unrealised profits before the market turns against you. Multiple strategies are possible, try out for yourself what works the best.

If you want to learn how to trade a proven trading strategy yourself (including a solid take profit strategy), have a look at my Trade Advisor program. It’s designed to get you up and running with my reversal trading strategy as fast as possible and it teaches you everything you need to know in order to have the best chances of success as a trader.

Good luck trading!