If you are into the stock or Forex market investment, you might have often heard about the term compound interest or using the compound interest calculator to get an idea of your net savings. In case you are baffled about how exactly to calculate the complex interest structure, here is your easy guide for dealing with this unique approach to interest calculation and how it can work towards your benefit in the overall investment scenario.

In common parlance compound interest is a calculation based on a method that also takes into account the interest accrued over a point of time thereby every cent of your investment is made to count and help in expanding your overall savings.

What Is Compound Interest?

First and foremost we get onto the definition bit. What exactly is meant by compound interest? It is a method where the interest calculation takes into account the principal as well as the interest accumulated over the course of investment and the period prior to when the compound interest is calculated.

In essence, it is therefore interest paid on interest and helps in a comparatively swifter expansion of your net savings. Compared to a scheme that pays simple interest, compound interest no doubt yields better returns and gives you a significantly better value for your money. The rate of interest accrual is of course dependent on the period over which interest is calculated whether it is annually, bi-annually or quarterly. Goes without saying that the actual interest calculated will be directly linked to the frequency. Greater the frequency of interest calculation, higher the interest accrued.

For example, if you are calculating interest on a principal of $100, compounding interest at 5% twice a year, i.e. every six months will yield you significantly higher returns compared to 10% interest calculated annually.

What Is Compound Interest Formula?

So that brings us to our next pit stop. This is ways to calculate the compound interest and the formula for calculating it. In simple mathematical terms, compound interest is the difference between the future value of the principal and interest and the present principal amount.

Thus:

Compound Interest = [P (1 + i)n] – P

‘P’ in this case stands for the Principal amount, and ‘i’ is the nominal rate of interest in percentage format. The time period or the period on which the compound interest is calculated is denoted by ‘n’.

When the time period for interest calculation exceeds a year, the ‘i’ needs to be divided by the ‘n’ or the total number of compounding periods every year.

Perhaps the calculation of compound interest is best illustrated using an example:

Let us assume that the principal amount is $5,000. It is invested at the rate of 5% compound interest annually. The period of the investment, let’s assume spans for 10 years. Then the total interest accrued would be $3,150, where the future value is $13,150, and the principal is $5,000:

P=$5,000

i = 5%

n = 10

Compound Interest = [$5,000 (1+5%)10] – $5,000 = $8,150 – $5,000 = $3,150

Supposing for the same amount, if the rate of interest was 5% bi-annually instead of 5% annually, the net compound interest accrued over the same period would be $6,381 – $5,000 = $1,381. The good difference of over $1000 on the interest accrued.

P=$5,000

i = 5%

n = 5

Compound Interest = [$5,000 (1+5%)5] – $5,000 = $6,381 – $5,000 = $1,381

Now for the same amount if the compound interest is calculated on a monthly basis, the amount after 10 years would be $1,744,559, and thus the interest accrued on the same amount would be $1,739,559.

P=$5,000

i = 5%

n = 120

Compound Interest = [$5,000 (1+5%)120] – $5,000 = $1,744,559 – $5,000 = $1,739,559

Thus, compound interest is particularly beneficial for long-term, and it can boost savings a lot more as compared to mere simple interest. The 10% simple interest on $10,000 for 10 years would yield $25,937.42 while compound interest of 5% on the same amount for 10 years will get you $16,288.95.

How To Calculate Compound Interest?

Most financial websites these days provide easy compound interest calculators. There are special software that support calculation of these complex interest rates. All you need to do is feed in the details of your investment and the period on which interest rate will be calculated. The projected value of your investment after the specific time period will be out in matter of minutes.

These online calculators are simple means to calculate your interest outgo while borrowing money or the gains via interest if you are lending the same. It is a simple step by step procedure which enables you get a clear perspective on the net outgo or the total inflow depending on the purpose of money you allocate for interest rate calculation.

All you need to do is log in and open the page that powers the online calculator.

- After that enter the principal on which you have to calculate the compound interest.

- Now enter the annual rate of interest that is levied on this sum.

- Enter the time period for which this investment/loan is earmarked for.

- You get details of interest accrued or the expected outgo.

Here is another illustration, this time let’s assume you want to take a 4-year loan to buy a car. So what would be the actual expense incurred as a result of the loan interest? Let’s calculate:

Say you need to borrow $5000 buy a car. The loan could be for 4 years at 8% interest rate. So you can log onto any online interest rate calculator and enter $5000 in the principal column. Your interest rate is 8% and the period of loan for 4 years. Once you click calculate, the software will on its own accord give you details of the exact amount due after the said period and how much of it is interest. In this case, the total outgo is $6802.44, and the interest outgo would be $1802.44 for the same period:

[$5,000 (1+8%)4] – $5,000 = $6,802.44 – $5,000 = $1,802.44Similarly in case of cash investments, the rate of interest when calculated the compounded way adds on to the interest accrued every month. As a result of this after the said investment period, your principal expands significantly higher than what it could have through simple interest.

However, whenever you opt for such tools of investment pay attention to the fine print and related expenses. Sometimes fees are charged separately and compound interest is calculated on varying duration, some calculate it on a monthly basis while other stake a quarterly and sometimes even annually calculated compound interest rate is levied.

Thus, the effective interest rate/yield/return or interest outgo would have to take into account all of these factors and put forth a net value which is the sum of all of these. When you compare the closing balance for the financial year with the opening balance for the same year, the difference after having subtracted expenses incurred due to charges and other factors gives you the actual interest earned.

How Does Compound Interest Work?

The way compound interest works to get the maximum returns for you is indeed interesting. However absurd it might sound if you are using it on your investments, it is perhaps just the few unique ways where the interest rate acts as a financial tool to further your profits.

Forex and stock market investors and trader often face a block where after reaping benefits of a good trading strategy, they are at a loss to decide on how to park their money to optimize the profits as well make the money grow.

Compound interest helps you build a sizeable savings pool over a period of time. No quick fix solution, it’s like the tortoise in the famous race. Slowly and steadily it works to increase your principal pool in a no risk, 100% reward situation.

The Power Of Compound Interest

That statement in itself is quite an appropriate manifestation of the power of compound interest. Compound interest perhaps is one of the best tools to realize the exact value of money as well as provide an alternative destination for forex and equity traders to expand the principal they plough into their daily investment cycle.

Also in a scenario where the inflation rate is either constantly growing or is encouraged to grow, the compound interest is like a safety valve that helps limit the losses associated with opportunity cost in our savings at times.

Calculated on the basis of time value of money that is invested or loaned using this technique, it mirrors the actual worth of $100 bill out in the market place and gives you the opportunity to use your trading strategies in a way that maximizes the return on investment.

Also, compound interest gives you the power to prepare better for future. Let’s say you want to create a retirement nest of $100,000 and have another 20 years of service remaining. However, you are confused about how much to save each month to attain this goal. All you need to do is feed in the target amount, the surplus money you can save for a desired time period every month on the basis of a specific interest rate in an online compound rate calculator. Almost instantly, you will have that magic monthly figure popping in front of you.

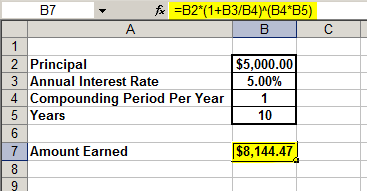

How To Calculate Compound Interest In Excel?

Excel can be a great tool for easy calculations without the use of a calculator, provided you know how to use it. The good part is you can learn these super fast as plotting these points on Excel is quite simple.

Always remember the basic formula to arrive at a result plays a key role in helping achieve the effective results of Excel. So feed in the basic compound interest formula of

P=A(1+i)

Into the topmost column near the header on an excel sheet. Now let’s create a spreadsheet with alternative options like compound interest calculated monthly and quarterly and have separate rows for number of years. As you fill in the times, the rate of interest and principal amount, you will easily get the final figure based on the different parameters and time periods that you calculate it on.

Not only does this simplify the calculation procedure but also gives you the opportunity to create and compare more than one scenario and finally take a call on the best possible and the most favorable solution for you.

Click Here to download our Excel compound interest calculator.

What Albert Einstein Says About Compound Interest

Perhaps in this context it becomes particularly pertinent to know how one of the greatest minds on earth, Albert Einstein viewed the concept of compounding interest. He considered it as the, “the greatest mathematical discovery of all time”.

The adaptability of compound interest is perhaps the biggest proof of the versatility and usefulness of this mathematical tool in our daily lives. Unlike Geometry or calculus with remain ensconced within the framework of text books, compound interest is out there in the open being applied to your trades, strategies, profits earned from the trades you executed and the final target savings that you might be looking at amassing.

As Einstein observed, “Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” He is even been learnt to have added that it is perhaps the “most powerful force in the universe.”

Though the exact content of what he exactly observed varies from source to source, the fact remains that a brilliant mind like his recognized the true potential of this forceful mathematics combination. Though there is never any mention of any specific context in which he might have mentioned this but it surely goes on to reiterate this modern tool to maximize returns for the many millions of risk averse investors whose contribution in the forex or equity markets is fairly limited.

Concluding

Time is money in the compound interest context. View in whatever perspective you will notice time comprises the most crucial factor in the compound interest conundrum. The time for which you get compound interest, the interval in which you earn compound interest and the time when you start getting compound interest all highlight the same fundamental factor that time determines the power and reach of the art of compounding your investments/loans.

Yes, state of art indeed. It can be safely termed at the most powerful tool to generate income amidst relatively the most benign risk reward circumstances. In simple term, sit is nothing but using your profits to generate more revenue and paying what you earned to earn more in an almost zero risk setup. Just being mindful of the associated charges and the tax rate along with the interval at which you get interest rate, your money works on its own to fatten up your profit line.