What is a divergence?

A divergence occurs when indicator moves in the opposite side of the price. So if the price rises and that the indicator falls there is a divergence. We speak of a bearish divergence because it announces a drop of the future price. In contrast, if the price drops and that the indicator rises, there is a bullish divergence. Divergence allows us to anticipate a movement of the price in one side or another before it comes out. Divergences appear on all types of indicators, the RSI, the MACD, the stochastic … They give the first signals of buying or selling before any other indicator. They allow you to detect a highest in an uptrend, or a lowest in a downtrend. There are two types of divergence, standard and hidden.

Standard divergences

As I said earlier, a divergence may be bullish or bearish. These are signs of reversal of the trend. Consider the two cases in more details:

– The bullish divergence: It is formed in a downtrend. To locate it, simply compare the various low points of the price and the indicator. If the price drops and that the indicator goes up, then we have a bullish divergence. There is a risk that the trend makes a reversal. You must sell. Here’s an example below:

– The bearish divergence: It is formed in an uptrend. To locate it, simply compare the various high points of the price and the indicator. If the price goes up and that the indicator drops, then we have a bearish divergence. There is a risk that the trend makes a reversal. You must buy. Here’s an example below:

Hidden divergences

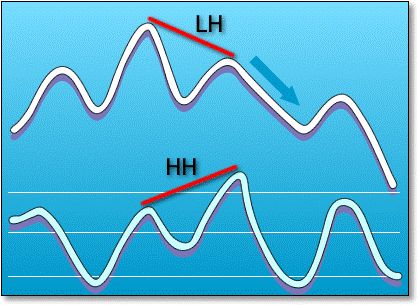

As well as standard divergences, hidden divergences can be bullish or bearish. There are signals of continuation of the trend.

– The bullish divergence: It is formed in an uptrend. To locate it, simply compare the various low points of the price and the indicator. If the price goes up and that the indicator drops, then we have a bullish divergence. So the uptrend is confirmed . You must buy. Here’s an example below:

– The bearish divergence: It is formed in a downtrend. To locate it, simply compare the various high points of the price and the indicator. If the price drops and that the indicator goes up, then we have a bearish divergence. So the downtrend is confirmed. You must sell. Here’s an example below:

Under what conditions divergences can be taken into consideration?

– First, it should be noted that divergences are indicators. They should not be used as the only indicator to enter a trade. Divergences give you a first signal like what you should pay attention, and thereafter if other indicators confirm the signal emitted divergences, then you can enter a trade.

– We must take into consideration signals emitted by divergences if the last highest price is higher than the previous one, or if the last lowest price is lower than the previous one. If the price formed a double top or double bottom, the signal is also valid.

– If the previous rule is applied, it must take into consideration the most speaking high and low points. If two peaks are formed with a large gap between them and at the same time on your chart, two low points appear with a reduced gap, you must take into consideration the two high points to draw your segment.

– Concentrate only on high points and low points of the price and the indicator and forget all that is between.

– If you draw a line connecting the highest on the price, you must draw a line connecting also the highest on your indicator. You cannot draw a segment connecting the highest on one chart and a segment connecting the lowest on your indicator for example.

– The highest recorded on the price must correspond to the highest on your indicator if a vertical line is drawn to connect them. If the highest of your indicator come out in the time after the highest of the price, the signal is not valid.

– The sloping of your segment connecting the highest or the lowest in the price must be different from the sloping of your segment connecting the highest or the lowest of your indicator.

– If you see a divergence but the reversal has already occurred, it is too late to trade the divergence.

– Noticed divergences on a longer timeframe are more effective than noticed divergences on the short term. Indeed, they give less false signals.