The GBP/USD currency pair staged a modest recovery on Friday, gaining approximately 0.4% and closing the first trading week of 2025 back above the 1.2400 level. Despite weak UK macroeconomic and consumer credit data earlier in the day, the low-tier figures had minimal market impact. Conversely, stronger-than-expected US business activity data buoyed investor sentiment, sustaining a relatively high-risk appetite.

US Economic Data Outpaces Expectations

The US ISM Manufacturing Purchasing Managers Index (PMI) for December exceeded forecasts, rising to 49.3 against an expected 48.4. This marks the highest reading in nine months for the manufacturing activity indicator. However, not all metrics painted a positive picture. The ISM Manufacturing Employment Index and the ISM Manufacturing Prices Paid Index both fell short of expectations. These figures suggest continued job cuts in the sector and underlying inflationary pressures at the producer level.

UK Data and Upcoming Calendar

In contrast, the UK’s economic calendar offered little to excite traders, with Friday’s data largely missing expectations. Looking ahead, the UK remains devoid of significant economic releases next week, with only low-impact data expected to be published.

On the US side, markets will pause on Thursday to honor the passing of former President Jimmy Carter, who died on December 29th at the age of 100. The week will conclude with the first Nonfarm Payrolls (NFP) report of 2025, a key indicator likely to influence market movements.

GBP/USD Weekly Outlook

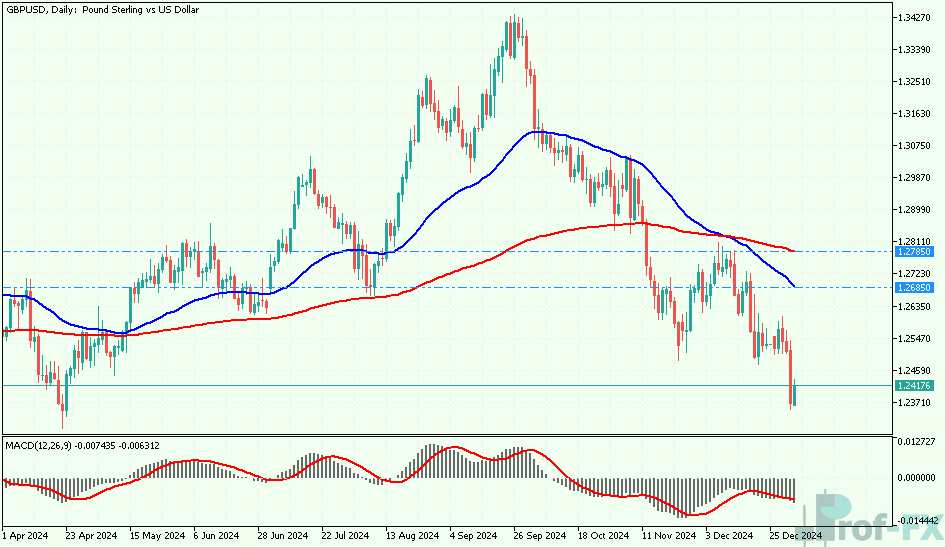

Despite Friday’s recovery above the 1.2400 threshold, GBP/USD concluded the week on a bearish note, down 1.3% overall. The pair remains vulnerable to further declines, with the potential to revisit late-2024 lows near 1.2300.

Technical indicators suggest a bearish bias in the near term. The 50-day and 200-day Exponential Moving Averages (EMAs), currently at 1.2685 and 1.2785 respectively, continue to display a bearish crossover, imposing a technical resistance ceiling on any upward moves.

As traders look ahead, GBP/USD’s performance will likely hinge on external factors, particularly US economic data, given the lack of impactful UK releases. The upcoming NFP report could be a decisive factor in shaping the pair’s trajectory in the near term.