Moving Averages (MA’s) are one of the most used technical indicators in forex. They smooth currency price data over a period of time. There are 3 types of moving averages:

Simple moving averages (SMA), exponential moving averages (EMA) and weighted moving averages (WMA). The most commonly used ones in forex are SMA and EMA.

The primary difference between simple moving averages and exponential moving averages is that exponential moving averages are weighted and give more importance to recent data.

USD/JPY Exponential Moving Averages (EMA) Daily Chart

Type of technical indicator: Trend Following

Why are moving averages so powerful?

Moving averages can be used in a number ways:

1) Determine the trend

Slope up: trend up, slope down: trend down, flat slope: sideways movement.

2) Determine the strength of trend

A moving average with a steep slope would imply a strong trend, while a moving average with a flatter slope would imply a weak trend.

3) Determine support or resistance levels

Moving averages frequently serve as support and resistance points.

4) Placing stop losses

In up trends: A prudent place to place a stop loss is below the rising moving average.

In downtrends: A prudent place to place a stop loss is above the falling moving average.

5) Determine entry points

Buy signal when the currency price rises and closes above the MA.

Sell signal when the currency price falls and closes below the MA.

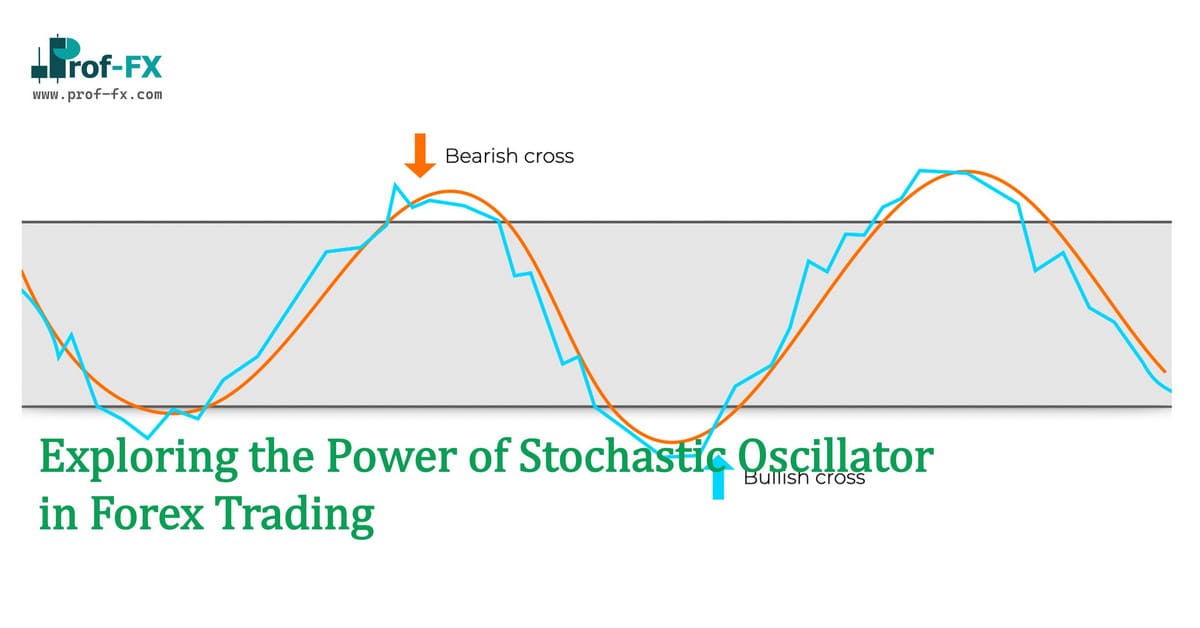

Forex cross-over signals from moving averages

A buy signal occurs when a fast moving average crosses above a slower moving average.

A sell signal occurs when a fast moving average crosses below a slower moving average.

USD/JPY 1 hour chart moving average cross-over signals

The most commonly used time periods for moving averages

- 200 (EMA and SMA)

- 100 SMA

- 50 (EMA and SMA)

- 89 SMA

- 20 (EMA and SMA)

- 10 EMA

Powerful trading combinations with moving averages

Utilizing moving averages alone produce less accurate trading signals. Therefore, it is strongly recommended to use moving averages in partnership with other analysis tools/indicators to make better trading decisions in the forex market. For example, combine with candlestick patterns and technical analysis oscillators.