The Fractal indicator, invented by Bill Williams is commonly used by forex traders to identify support and resistance levels on the charts. Fractals are composed of five consecutive candlesticks.

They are always lagging behind the price action, and therefore it’s not recommended to use them as a stand-alone forex indicator.

Bullish Fractal Pattern

A pattern that consists of five consecutive candlesticks with the lowest low in the middle, preceded by two higher lows and followed by two higher lows. This pattern is bullish in nature when found in an up trending market.

Bearish Fractal Pattern

A pattern that consists of five consecutive candlesticks with the highest high in the middle, preceded by two lower highs and followed by two lower highs. This pattern is bearish in nature when found in a down trending forex market.

EUR/USD Fractals Hourly Chart

Type of technical indicator: Lagging Chart Overlay

Forex signals from Bill William’s Fractal Indicator

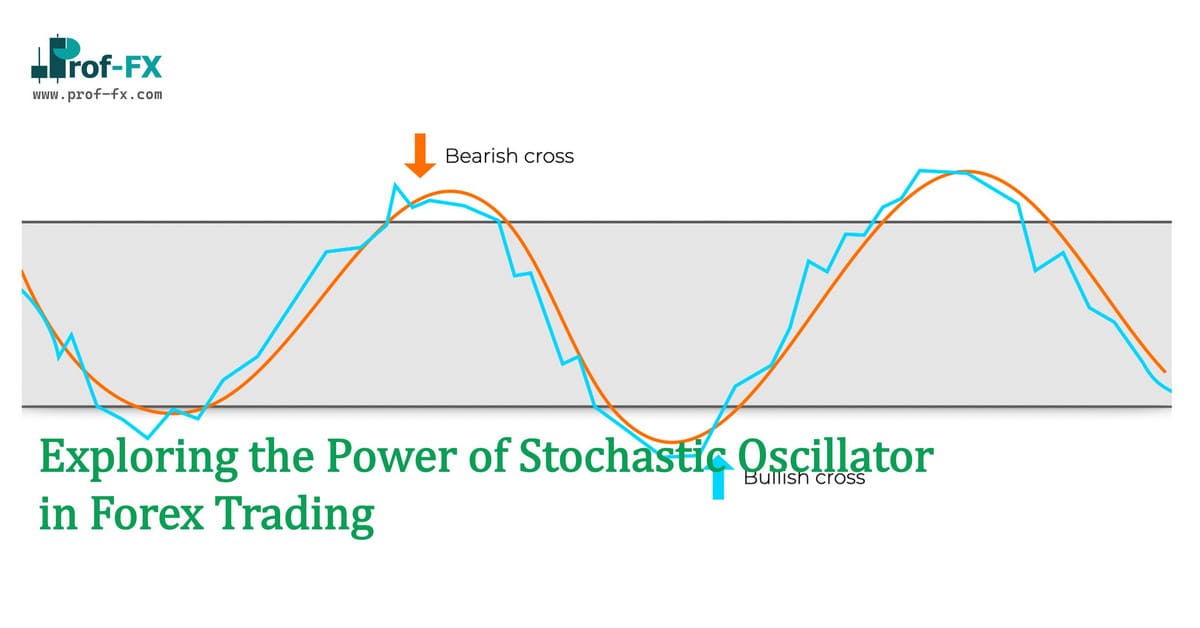

Fractals themselves do not provide any trading signals in real-time since they appear on the forex chart after the 5th candlestick has been formed. Always use in conjunction with other analysis tools/indicators such as moving averages, candlestick patterns, the Alligator indicator by Bill Williams …

Fractal Forex Trading Ideas

- In strong up trending markets, look for long trades after a bullish fractal pattern has been formed on the chart.

- In strong down trending markets, look for short trades after a bearish fractal pattern has been formed on the chart.

- Utilize Fractals to draw powerful trend lines.

Drawing rising trend lines

In order to draw a rising trend line, connect the successive bullish fractals.

Drawing falling trend lines

In order to draw a falling trend line, connect the successive bearish fractals.