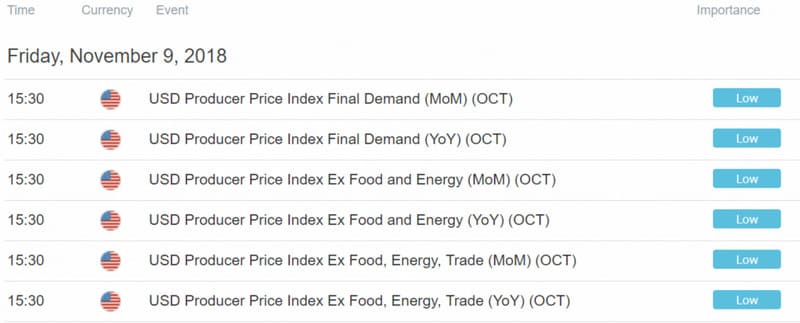

The Producer Price Index (PPI) is a critical economic indicator that forex traders use to gauge inflation trends and predict future market movements. Released during the second week of each month, PPI measures the average change in prices that producers receive for their goods and services. For forex traders, PPI serves as a leading indicator for consumer inflation, as measured by the Consumer Price Index (CPI). Understanding PPI can help traders anticipate interest rate changes and their subsequent impact on currency pairs. Let’s dive deeper into what PPI is, how it’s calculated, and how it influences the forex market.

What Is PPI and What Does It Measure?

The Producer Price Index (PPI) tracks the price changes of finished goods and services sold by producers. It reflects the monthly fluctuations in the average price of a basket of goods purchased by manufacturers. By monitoring PPI, traders can identify early signs of inflation, which often trickles down to consumers.

PPI focuses on three main production areas:

- Commodity-based – Raw materials and agricultural products.

- Industrial-based – Goods produced by manufacturing industries.

- Stage-of-processing-based – Products at different stages of production.

The Bureau of Labor Statistics (BLS) calculates PPI using data from a survey of retailers, selected through systematic sampling. Traders can analyze PPI data as a percentage change from the previous month or year.

The Connection Between PPI and Inflation

A rising PPI indicates that producers are paying more for goods and services. Over time, these increased costs are often passed on to consumers, leading to higher consumer prices. This chain reaction is reflected in the CPI, which measures the average price change for goods and services purchased by households.

Inflation, when controlled, can be beneficial for an economy. It signals growing demand, prompting businesses to invest more and hire additional workers. However, excessive inflation erodes the purchasing power of a currency. For example, $1 today buys far less than it did decades ago. Central banks often combat high inflation by raising interest rates, which can strengthen the local currency.

How PPI Impacts Currency Values

PPI indirectly influences currency values through its effect on inflation and interest rates. When PPI rises, it often signals future inflation, prompting central banks to raise interest rates. Higher interest rates make saving more attractive, as the returns on savings increase. Conversely, spending becomes more expensive, as consumers lose out on potential interest earnings.

For example, if the Eurozone’s PPI rises, the European Central Bank (ECB) may increase interest rates to curb inflation. Higher interest rates attract foreign investors seeking better returns, driving up demand for the Euro and strengthening its value.

A popular forex strategy tied to interest rates is the carry trade. In this strategy, traders borrow in a low-interest-rate currency and invest in a higher-yielding one, profiting from the interest rate differential.

How PPI Affects the US Dollar

Initially, PPI may have a minimal direct impact on the US dollar. This is because there’s often a time lag between rising producer prices and their effect on consumer inflation. However, astute traders use PPI as a signaling tool to forecast future CPI data and interest rate changes.

While PPI might seem like a low-priority data release, its predictive value makes it a crucial indicator for forex traders. By analyzing PPI trends, traders can anticipate central bank actions and position themselves accordingly.

Why PPI Matters in Forex Trading

PPI is just one piece of the puzzle in fundamental analysis, but its implications are far-reaching. By understanding PPI, traders can better predict inflation trends, interest rate changes, and currency movements. Other essential economic indicators include:

- CPI (Consumer Price Index)

- ISM (Institute for Supply Management) data

- Non-farm payroll statistics

- GDP (Gross Domestic Product)

Fundamental analysis is one of the three primary types of forex analysis, alongside technical and sentiment analysis. It’s particularly valuable for predicting long-term trends and making informed trading decisions.

Final Thoughts

The Producer Price Index (PPI) is a powerful tool for forex traders, offering insights into inflation trends and potential interest rate changes. By monitoring PPI data, traders can anticipate market movements and develop strategies to capitalize on currency fluctuations.

Stay ahead of the game by keeping an eye on key economic data releases through an economic calendar. Remember, while data releases can create significant market volatility, proper risk management is essential to navigate these movements successfully.

By incorporating PPI into your trading strategy, you can gain a deeper understanding of the forex market and make more informed decisions. Happy trading!