One of the most important things to remember when you are trading in the Forex market is that the market is populated by people just like you. Ultimately, it is people who drive this market, and that means that human emotions (especially fear) are ever present.

Investor fear is one of the most potent forces in today’s currency market. In fact, it is so important that it tends to trump many other fundamental factors when it starts to rear its ugly head. Investor fear can send some currencies crashing down when times turn sour. The opposite is also true: investor fear can send some currencies soaring when times are rough.

To take advantage of this market dynamic, you need to know which currencies tend to thrive when times are bad.

Safe-Haven Currencies

Safe-haven currencies thrive when investor fear is running amok. They are called safe-haven currencies because of the perceived protection that they offer during times of financial turmoil. At the time of this writing, the U.S. dollar (USD), the Swiss franc (CHF), and the Japanese yen (JPY) seem to be the most popular safe-haven currencies.

Each of these currencies is deemed to be a safe haven for a different reason. The U.S. dollar is a safe-haven currency because investors seem to flock to the safety of U.S. Treasuries when the global financial market enters crisis mode. This increase in demand for U.S. Treasuries leads to an increase in demand for the U.S. dollar, which pushes the value of the U.S. dollar higher. And after all, don’t you want your safe-haven currency to appreciate when things look bleak?

The Swiss franc is considered to be a safe-haven currency because a large portion of the Swiss francs in circulation are backed by gold. The percentage of currency that is backed by gold isn’t quite as high as it used to be, but compared to many other fiat currencies, the Swiss franc has incredibly stable gold backing. The Swiss economy is also considered to be an incredibly stable economy with low levels of inflation.

The Japanese yen is a safe-haven currency because of the security of the Japanese government debt market. Unlike the U.S. public debt, which is held largely by foreign governments and investors, the Japanese public debt is held almost exclusively by individual Japanese investors. This provides a lot of stability to the Japanese economy and provides less incentive for the government to try to inflate its way out of its debt obligations—something that other countries have been known to do when their debt burden became too onerous. A currency that faces less risk of inflation is a much safer currency.

Now that you know which currencies like market turmoil, all you have to do is gauge just how fearful or confident the market is in general.

Measuring Investor Fear

Investor fear and confidence are also two of the most nebulous forces to monitor and analyze because there is no quantitative way to measure fear . . . or is there?

One indicator that you can use to gauge investor fear is the CBOE Volatility Index (VIX), here are the basics:

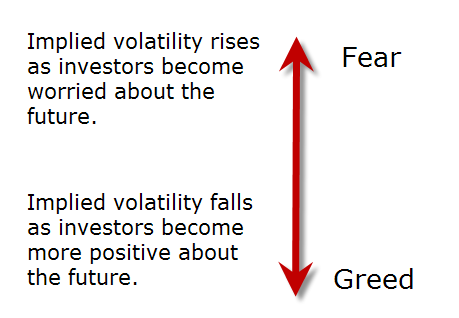

- The VIX is based on the implied volatility levels of S&P 500 Index options.

- When the VIX is moving higher, it indicates that investor fear is increasing.

- When the VIX is moving lower, it indicates that investor fear is decreasing.

Now, you may be wondering why we are talking about watching an indicator based on stock index options when we are investing in the Forex market, but you would be surprised at how tightly coordinated the financial markets of the world are. We can learn a lot by watching markets other than the Forex market.