Today, the use of Japanese candlesticks is the most used graphic representation. More readable, more relevant, the Japanese candlestick representation offers a real help to the decision to enter or exit a position on the market. It should be noted that Japanese candlesticks are not sufficient alone to take your decisions. They must be coupled with indicators, which support or not the message delivered by the candlestick.

Japanese candlesticks allow mainly detecting areas of market reversal.

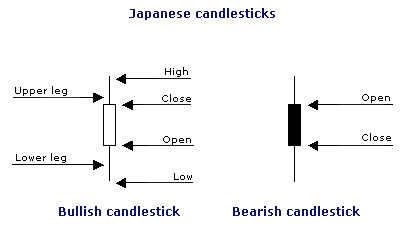

Basic presentation of Japanese Candlesticks :

A white candlestick (bullish market) is the Yang (yo-sen), a black candlestick (bearish market) is the Yin (in-sen).

Basic rules of candlesticks:

A – Timing should never be changed for decision making. However, it is quite advisable to change Timing for a long term analysis. Candlestick can give two indications completely opposite on the next movement. Eg: you see a reversal on a 15min charts but the1h charts can well indicate that the trend should continue. It can simply have a correction on the15 min chart and then the movement can poursuit. That is why you must never change your timing to take your decision. If you are on 15 minutes chart, you get a reversal, and normally, a second one for the continuation of the movement..

B – A candlestick should always be analyzed according to the trend or the movement that preceded it.

C – Always wait for a confirmation of the next candlestick to validate the decision of entry (or exit).

Reversal figures with Japanese candlestick

– Doji: A doji can be a plus sign, a cross or a reverse cross. The common point of these doji is that the opening price is the same as the closing price (or almost). The doji often appear after a strong move. A doji cross is more neutral (middle). However, a reverse doji cross (on the right) is bearish if it appears in an bullish movement (Evening doji star or abandoned baby of the evening). Conversely, a doji cross(left) is bullish if it is in a bearish movement (morning doji star or abandoned baby of the morning).

– Doji with long legs: it has long high and low shadows. He is a strong sign of indecision.

– Geavestone doji: (its opposite is the dragon fly doji, shaped as a T) Gravestone doji indicates that buyers dominated the first part of the formation of the candlestick, but sellers have been strong enough to push back the price to the opening price, in the second half of the session. The gravestone doji is a strong sign of reversal. Its signal is stronger if the doji appears in a bullish trend. (Inversely for the dragon fly doji).

– Whirligig with long shadows: this figure is the same as a doji cross except that movements that built it were more violent and that the price does not close at the same price as the opening price. It is a reflection of high uncertainty, but can also be interpreted as a figure of reversal if it appears at the end of a strong movement.

– Hammer: The hammer is a figure of reversal. It appears in bearish trend and it is a sign of a bullish reversal. It is said that it is poundering the decrease. The long shadow indicates that the price has been face to a significant selling pressure but this one has disappeared at the end of the formation of the candlestick. It is better to wait a passing of the highest of the hammer by the next as a confirmation. The hammer can also play a role of spring. There is a spring when bears are unable to maintain the price below a broken support area. The shadow breaks violently the support but bounces over this line just after. (Inversely for hanging man)

– Morning star and evening star: the same as the morning doji star and the evening doji star but the reversal candlestick is not a doji. It should be noted that the candlestick star will have a higher power of reversal if it is created with a gap.

– Shooting star: the shooting star implies that the Bullish have oriented the price during the first part of the formation of the candlestick but that the Bearish took back the control in the second part. The trend is being challenged on the occurrence of a shooting star. The next candlestick will be waited to confirm it. It should be noted that a shooting star with a gap has a higher power of reversal.

– Inverted hammer: the inverted hammer is created in a bearish trend. It implies that buyers have pushed the price to rise in the early formation of the candlestick but the selling pressure has diminished the reversal. It is a figure that requires more to be confirmed by the next candlestick.

– Black cloud coverage: Figure very usual during the announcement of economic news on the Forex. It is formed by two consecutive candlesticks. The first one is a long white candlestick. The second one is a long black candlestick. It comes out in a bullish trend or at the top of a resistance area. The level of opening and closing price of the black candlestick determines the strength of reversal of the black cloud coverage.

The important points:

- More the level of the closing price of the black candlestick is close to the level of opening of the white candlestick, the stronger the reversal signal is.

- More the opening of the black candlestick is above the closing price of the white candlestick, more the signal is bearish.

- More the candlestick are long, more the signal is bearish.

- The confirmation of the figure is important. To be valid, the next candlestick should finish under the black candlestick of the coverage black cloud.

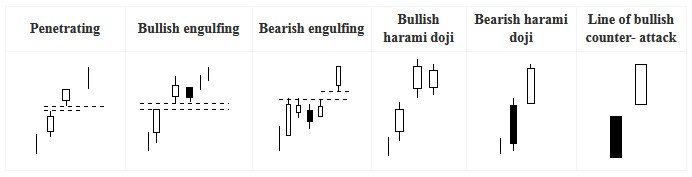

– Penetrating: Unlike the black cloud coverage. Bearish trend at the beginning. Reversal figure which must be validated. Enter in a bullish trend.

– Bullish engulfing and bearish engulfing: (or bullish or bearish swallowing) The swallowing structure are reversal figure very effective and frequent. If a bullish swallowing appears in a bearish trend, you must be very careful and check that it really breaks a level of resistance. If the white body swallows the entire black candlestick that precede it (body and shadow), then it is a bullish key reversal. A bullish key reversal is necessarily an bullish swallowing, but the reverse is not true. All figures of swallowing must necessarily open lower (/higher) that the level of closing (opening) of the first candlestick, and close above (/ lower) than the level of openness (/ closing) of the first candlestick. More the candlestick of the swallowing structure are long, greater the signal is.

– Harami (Harami doji or whirligig): The Haram in a composition of a mother candlestick and a candlestick in position Harami. A candlestick in position Harami is a candlestick that is formed in the body of the previous candlestick. However, the legs of the Harami should not necessarily be contained in the body of the previous candlestick. The first candlestick must have a long body. The Harami may be a doji or a spinning top, as far as his body is inside the body of the mother candlestick. The candlestick in Harami position can be double, which will increase the signal of reversal.

– Line of bullish counter-attack (or line of bullish connecting) They result from two candlesticks, the closing of the first one will match with the closing price of the second. These candlesticks reverse the movement in progress and provide signals of buying. (of sell for the line of bearish connecting, next figure). It is better to wait for a confirmation by the next candlestick to confirm the reversal.

– Top clip: (opposite bottom clip) relatively similar to the black cloud coverage. The top clip is a reversal figure special by the fact that the higher of the two candlesticks whick formed it are at the same level. (Conversely, two lower for the bottom clip). This configuration may appear in various ways, with or without shadows, with formation of a hanging man (vice hammer, according to the trend that preceded), with a doji which will be in Harami position, with swallowing and so on.

Figures of continuation with Japanese candlesticks

– Bullish Gap: (opposite of bearish gap) A bullish gap appears when the opening of a candlestick is made higher than the closing price of the previous candlestick. In a bullish trend, a gap is extremely bullish, although generally speaking, gaps are often consolidated afterward.

– Ascending Tasuki gap (opposite descending Tasuki gap): It results of the formation of three candlesticks. The first two are both bullish candlesticks and separated by a gap, the third is a bearish candlestick opening at the inside of the body and usually end at the inside of the gap. The ascending Tasuki gap tends to continue the current trend. There are several ways to trade it: Enter long at the closing of the third candlestick – Enter long at the next candlestick when he will get over the third candlestick (more secure because the figure is then validated).

– Bullish play gap: (opposite bearish play gap) It is a gap which was established after the formation of a line of resistance. This line of resistance is then violently broken by the gap. The bullish will normally continue thereafter.

– Bullish white twins: The figure results from the formation of three candlesticks with a gap, the opening the third chandelier is approximately at the same level as the previous candlestick but the closing price is also upward and at the same level. This figure can be considered as bullish if the previous gap is bullish. In contrast, the figure could be considered as bearish if the gap is bearish. (The figure will be composed of a bearish candlestick, a bearish gap, and two identical bullish candlesticks).

– Bullish line of separation: (opposite bearish line of separation) is the combination of two candlesticks. It extends the current trend and makes a signal to buy or sell depending on the current movement. The first candlestick is a large black one, the second opens at the opening price of the first one and does almost not have any shadow. The black candlestick raises some scepticism among bulls, but the white one come to reassure and revive the movement. (Conversely for the bearish line of separation).

– Bullish kick: (opposite bearish kick) Figure composed of two marubozu separated by a gap. Figure of continuation.