In the world of forex trading, indicators are essential tools that help traders make informed decisions about when to enter or exit the market. Two major types of indicators are leading and lagging indicators, each with its own strengths and weaknesses. But when it comes down to choosing between the two, how do traders decide which one to use? The answer often depends on the trader’s style and goals, along with understanding the unique advantages and limitations of each.

What Are Lagging and Leading Indicators?

Lagging Indicators

As the name suggests, lagging indicators are tools that analyze past price data to help traders understand market trends. These indicators react to price movements that have already occurred, confirming the trend after it has already started. While this may result in more reliable signals, it also means traders could miss out on entering a trade at the beginning of a move.

Many traders accept this delay as a necessary trade-off in order to avoid entering a position too early and risking false signals. However, others view it as a lost opportunity.

Some popular lagging indicators include:

- Moving Average Convergence Divergence (MACD)

- Simple Moving Averages (SMA)

- Stochastic Oscillator

- Relative Strength Index (RSI)

Leading Indicators

On the other hand, leading indicators attempt to predict future price movements by analyzing past data, allowing traders to anticipate price changes before they actually happen. This means that, with leading indicators, traders can enter trades earlier, possibly capitalizing on the beginning of a new trend. However, predicting future movements can be risky, as these indicators don’t always deliver accurate forecasts, leading to false breakouts or minor retracements rather than trend reversals.

Common leading indicators include:

- Fibonacci retracements

- Donchian channels

- Support and resistance levels

Leading vs Lagging Indicators: Pros and Cons

To help traders decide which indicator suits their strategy, it’s important to understand the advantages and limitations of both.

Advantages of Leading Indicators

- Early Entry Signals: Leading indicators can provide favorable entry points at the start of a price move, giving traders a potential edge by entering early.

- Identify Key Levels: These indicators can help traders spot key levels that might suggest future price movements, enhancing the probability of successful trades.

Advantages of Lagging Indicators

- Confirmation of Market Movement: Lagging indicators provide greater confidence by confirming whether a trend has gathered enough momentum to sustain itself.

- Risk Reduction: They help reduce the risk of false breakouts by waiting for more reliable signals based on recent price action.

Disadvantages of Leading Indicators

- Uncertainty: Leading indicators forecast price action that is not guaranteed. Traders need to combine their understanding of market conditions with these indicators to improve accuracy.

- Complexity: More advanced traders may find leading indicators particularly useful, but they can be challenging for beginners, especially when combined with complex techniques like Elliott Wave Theory.

Disadvantages of Lagging Indicators

- Missed Opportunities: By waiting for confirmation from lagging indicators, traders might lose out on the early part of a price move.

- Lack of Key Level Awareness: Lagging indicators don’t inherently recognize key price levels like support or resistance, so traders need to be vigilant about these factors.

Leading vs Lagging Indicators: Which One Should You Use?

There’s no one-size-fits-all answer when it comes to choosing between leading and lagging indicators. As with any trading tool, indicators are designed to help traders make better decisions, but they can never guarantee success. Traders must combine the use of indicators with solid analysis to improve their chances of success.

For example, let’s take a look at how leading and lagging indicators might play out in a real-world situation with the EUR/USD currency pair. In this case, a leading indicator might provide a better signal.

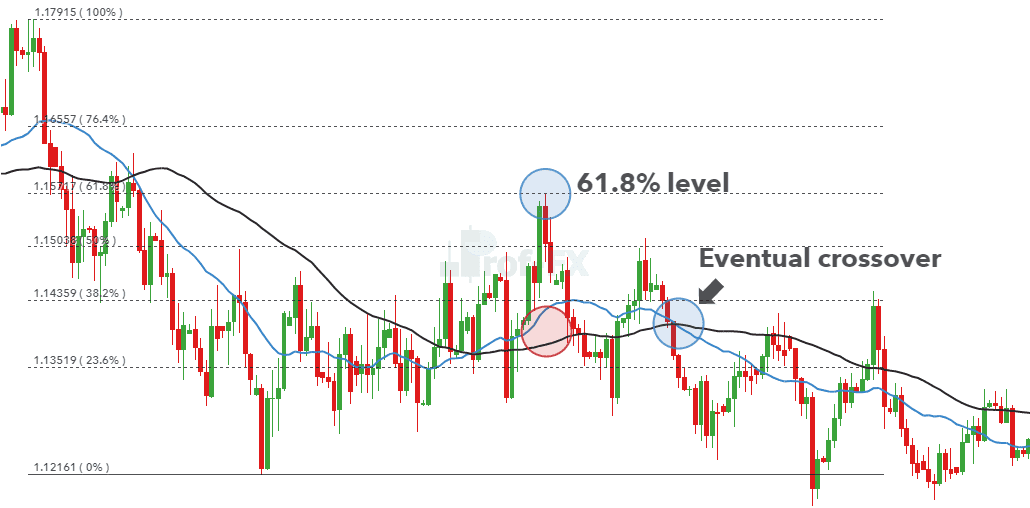

In the scenario, the market has seen a sharp sell-off before retracing to the 61.8% Fibonacci retracement level. If we apply a simple moving average (SMA) with different periods like 21, 55, and 200, the faster 21-period SMA hasn’t yet crossed below the slower 55-period SMA, so the lagging indicator hasn’t confirmed a short position.

However, when looking more closely, traders would notice that the market has failed to break and hold above the 200-day moving average, a key indicator of long-term trend direction. This level now acts as resistance, suggesting a bearish bias for traders watching for a bounce off the Fibonacci level.

Finding the Right Balance

Traders who prefer quicker signals may lean toward leading indicators, but they often adjust the time frame of lagging indicators to make them more responsive. However, it’s crucial to implement strict risk management strategies—such as setting tight stop losses—to protect against potential reversals.

Traders who prioritize greater confidence in their trades might favor lagging indicators. These traders typically trade on longer time frames, waiting for a clearer trend to develop before entering, with a focus on managing risk carefully.

Frequently Asked Questions (FAQs)

1. Do leading indicators provide faster signals and therefore are superior to lagging indicators?

It’s tempting to think that leading indicators are always better because they give early signals. However, it’s important to remember that leading indicators forecast potential movements, but they’re not foolproof. More analysis, including assessing trend, sentiment, and momentum, should be done before making trading decisions.

2. Which combination of moving averages works best?

The choice of moving averages often comes down to personal preference, but some common combinations include the 20, 50, 100, and 200-period SMAs. For quicker signals, traders often use a 21-period moving average alongside the 55-period SMA. Longer-term trend analysis may rely on the 100 and 200-period SMAs.

Ultimately, successful traders understand that the combination of indicators—leading and lagging—depends on their specific trading strategy, market conditions, and personal preferences. By weighing the advantages and limitations of each, they can develop a more effective approach to forex trading.