The Stochastic oscillator, invented by George Lane measures momentum in the market and consists of two lines (%D and %K).

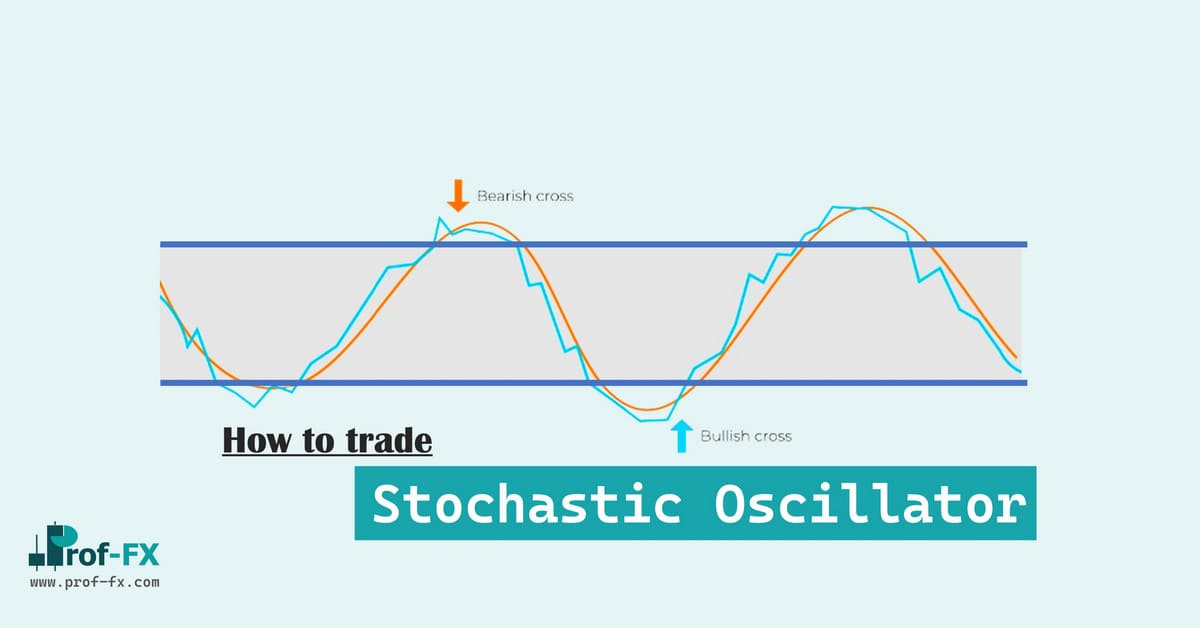

The Stochastic oscillator oscillates between 0 and 100 while readings above 80 are considered overbought and readings below 20 considered oversold. Values between 20 and 80 are considered neutral.

AUD/USD Stochastic Oscillator (Stoch) Hourly Chart

Type of technical indicator: Momentum oscillator

Forex signals from the Stochastic oscillator

1. In trending markets

Oversold values (0-20): Look to buy dips in uptrends.

Overbought values (80-100): Look to sell rallies in downtrends.

2. In rangebound markets

Oversold values (0-20): Look for opportunities to buy near the low of the trading range.

Overbought values (80-100): Look for opportunities to sell near the high of the trading range.

Powerful trading combinations with the Stochastic indicator

Always use the Stochastic oscillator in conjunction with other analysis tools/indicators to make better trading decisions in the forex market.