If you ask me how much pips I made last month, I will tell you I don’t know.

But I will know my R-multiple of a couple months is a 6.1R profit. This R number often results in confused looks. What does R stand for? What the meaning?

In order to figure this out, we need to take a step back and look at our performance and its relationship with risk in our trading activity.

Risk and Reward To Risk

When you say that you made a 50 pip profit, that only tells me part of the story. The key piece of information that is missing here is how much you risked to make this profit. After all, a 50 pip profit is a good result if you had a 25 pip stop loss but if your stop loss was 200 pips, you risked a lot to get a relatively small reward.

Reward to risk is much more important than pip value

In the first example, your profit is twice as much as your risk. Your reward:risk ratio is therefore 2:1. In the second example, however, your profit is only 1/4th of your risk. This results in a much less appealing reward:risk ratio of 0.25:1.

While there are many different ways to trade, we can agree that if you have a strategy with the same win rate, the 2:1 reward:risk ratio will give you a much better expectancy.

But if not with pips, how can we measure these risk-adjusted returns? That’s where R and R-multiples come in.

Now, we talking About R

The R stands for Initial Risk. The initial risk is how much are you willing to lose on a single trade. The initial risk can be expressed in percentage of account size (e.g. 1%) or the dollar amount (e.g. $50) that you lose when the price hits your stop loss.

Let’s go with an example here. You go long 0.1 lot on EURUSD with a 100 pips stop loss. Unfortunately, the price moves against you, hits your stop loss and you lose $100. That $100 is your initial risk or 1R. You can say you just lost 1R.

On R-Multiples

Now, all profits and losses can be expressed as a multiple of the initial risk R. That multiple is called the R-multiple. You want your losses to be 1R or less and your profits to be as big as possible.

Let’s go back to our EURUSD example and let’s say you saw that the price was going against you and you cut your losses half-way towards your stop loss:

You have only lost $50 now, instead of the full $100 of your stop loss. To express this as a multiple of the initial risk (or R), we can do the following:

Initial risk (or 1R) = $100Loss = -$50

R-multiple = profit or loss / initial risk = -$50 / $100 = -0.5R

The R-multiple on this trade is a loss of -0.5R. Let’s look at another scenario on this trade, where we take profits at the highs:

We ended up with a profit of $128. Again, we can calculate our R-multiple as a multiple of the initial risk (or R):

Initial risk (or 1R) = $100Profit = $128

R-multiple = profit or loss / initial risk = $128 / $100 = 1.28R

We just made 1.28R on this trade, nice job!

Total R-Multiple

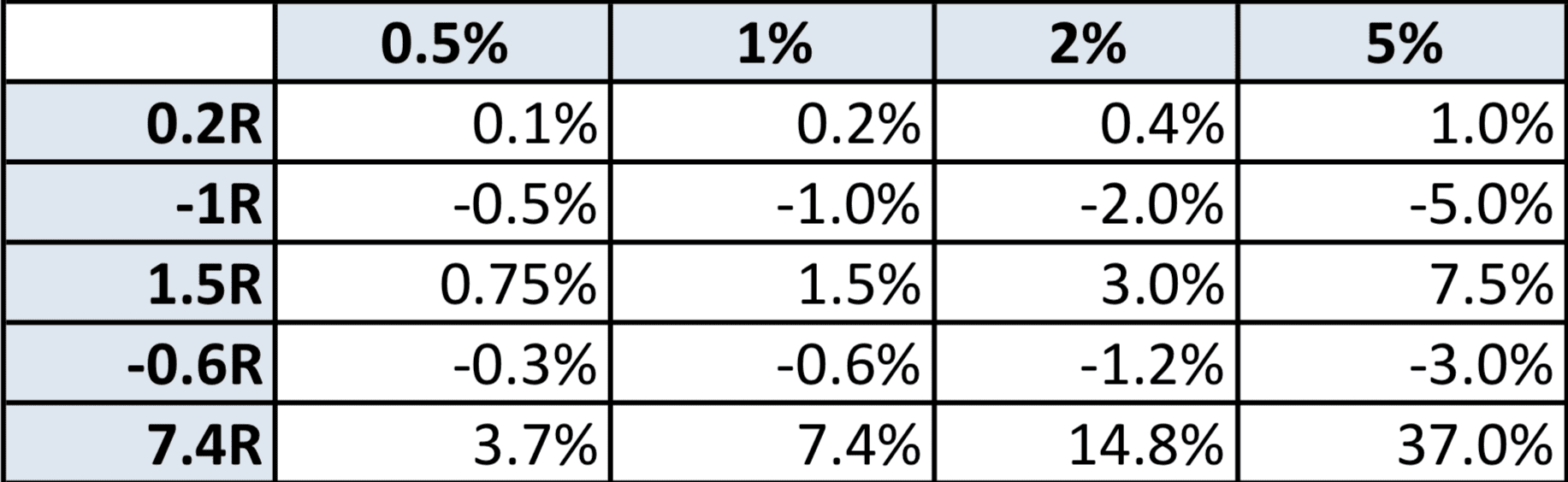

Since we can express the result of every trade as its R-multiple value, it also becomes easy to calculate the R-multiple sum of many trades. Imagine that you had 5 trades last week:

- Trade 1 (loss): -0.2R

- Trade 2 (win): +3.2R

- Trade 3 (win): +0.94R

- Trade 4 (loss): -1.0R

- Trade 5 (break-even): 0.0R

By adding up the above values, we can then say that our total R-multiple for this week was +2.94R. This one number represents how our performance was for that week, not just in terms of profits or losses made, but also in terms of how much risk we had to take for this. It’s a much more accurate way of evaluating performance than just pips or ticks.

R-multiple And Position Sizing

Using R and R-multiples, we can accurately measure our performance. But how does this relate to the actual dollar value of our trades? After all, consider the following two trades:

- Trade A: a $50 stop loss and a $100 take profit

- Trade B: a $200 stop loss and a $400 take profit

When we assume that both are winners, we can say that both trades represent a 2R profit. Yet, one trade made us $100 and the other trade resulted in a $400 profit! How does this relate to R-multiples? The answer is position sizing.

Position sizing refers to the number of units we use when we put on a trade. With forex trading, this means our lot size. In futures trading, it means the number of contracts we put on and in stocks, it comes down to the number of shares we trade in one position.

By adjusting our position size, we can change how much we stand to risk (or gain) when we put on a trade. Usually, a trader would choose a position sizing strategy and while a full overview of position sizing falls outside of the scope of this article, I’m going to highlight one strategy.

Fixed Fractional Position Sizing Strategy

In this strategy, we adjust the size of our position in such a way that our initial risk (or 1R) always represents a fixed percentage of our account size. Imagine that your account size is $10,000 and you want to risk 1% per trade, then every trade you put on has an initial risk of $10,000 / 100 = $100.

Fixed fractional position sizing makes sure that when your account size grows, the risk you take per trade also grows accordingly. When you increased your account to $15,000, then 1% of that means that every trade you put on has an initial risk of $150.

Assuming 1% of risk per trade, it also means that 1R equals 1%. Imagine that you end up making a profit of 4.5R in one month. Using fixed fractional position sizing, that will equal an account balance increase of about 4.5%. If your risk per trade would be 2%, a 4.5R profit would equal an account balance increase of 9%.

Conclusion

Instead of using just pips, using the concepts of R and R-multiples provide a powerful way to view your performance with risk in mind. When your performance is measured against the amount of risk to achieve it, the result is a more realistic way to determine how good your trading is.