I know a lot of traders who try to become profitable using a multitude of indicators (or a combination thereof). Hell, it was my strategy for about a full year when I was starting out trading! It didn’t work for me. While indicators are not inherently bad, there’s a good chance that it didn’t work out for you too. If it did, a lot more than the 10% of traders that are said to be profitable in this business would make a killing, but they don’t.

Gradually though, I started to change the way I approached trading and immersed myself in price action trading. By now, price action is my main way of trading and my Trade Advisor friend can attest to how effective it is.

But… Price action is a whole other beast.

Different species. Stands apart from all the other technical analysis tools.

And a lot of traders don’t understand how to trade it.

It’s understandable though.

It’s not an indicator in the traditional sense. You can’t read price action in the unambiguous way you can know if the RSI indicator has crossed the 70 mark. It’s the reason beginning traders flock to indicators you can quantify easily. RSI, MACD, Stochastic, ATR. The list could go on. While these indicators have their use, they’re not something I solely base my trading ideas on. Most of them are lagging and just plain not working as a trading strategy.

Believe me, I’ve built trading robots based on about every popular indicator (or combination of indicators) you can find. It’s a trap for beginning traders and every single one of them loses money on it.

Instead, learning about price action is the best way to become a profitable trader.

And I’m going to tell you the price action secrets that matter. The ones you need to make the best trades. But first, we need some background.

Price action trading introduction

What exactly is price action trading? Wikipedia defines it like this:

The concept of price action trading embodies the analysis of basic price movement as a methodology for financial speculation, as used by many retail traders and often institutionally where algorithmic trading is not employed. Since it ignores the fundamental factors of a security and looks primarily at the security’s price history — although sometimes it considers values derived from that price history — it is a form of technical analysis.

That’s a pretty incomprehensible description though. Forget it.

Here’s my definition of price action:

Price action trading is a trading methodology that uses the movement of price as input for making trading decisions. It allows you to tell a story of what the price is doing and make higher probability trades based on that story. It is a form of technical analysis.

Notice how I said you can tell a story about the price. I believe that is one of the most important skills you can have as a price action trader and we’ll get back to this later on.

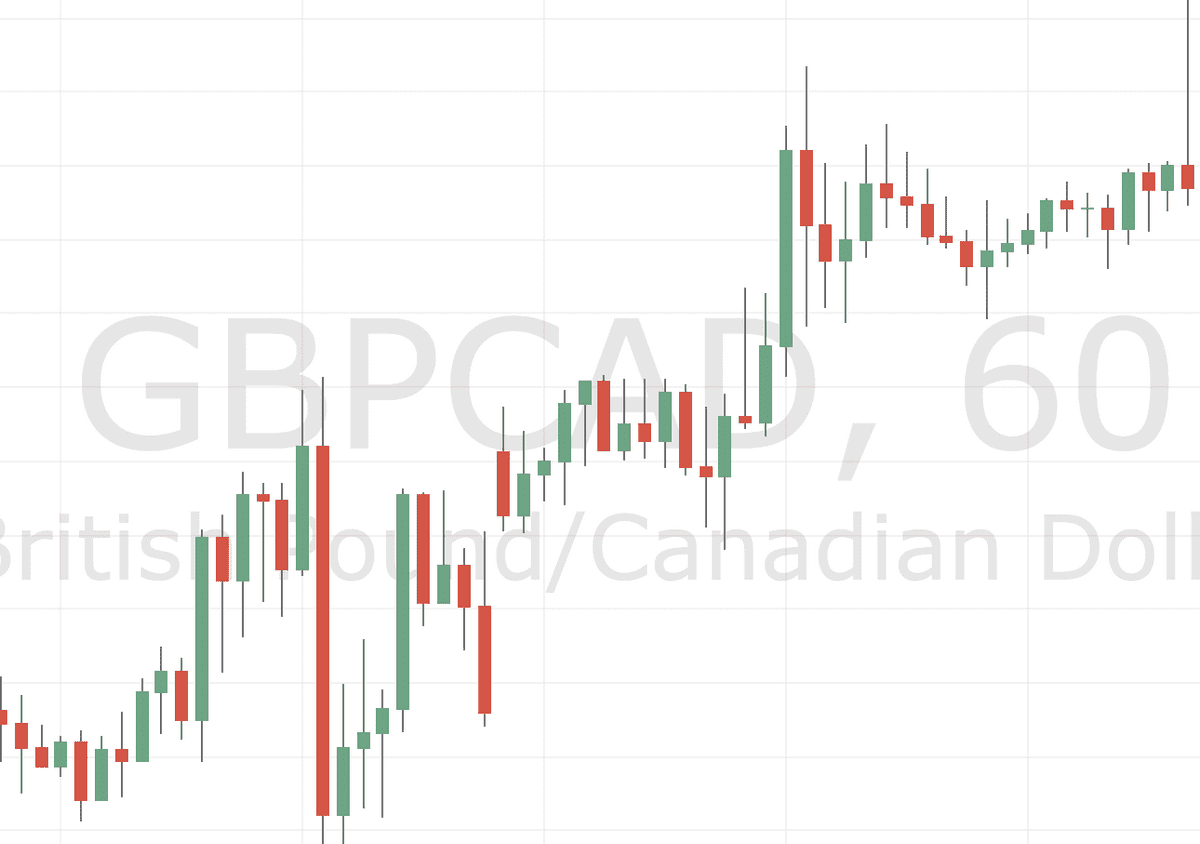

This is how a price action chart usually looks:

Notice how clean this looks? No indicator windows, only pure focus on the price. Once you’re used to this charting view, you will start to realise the power of price action.

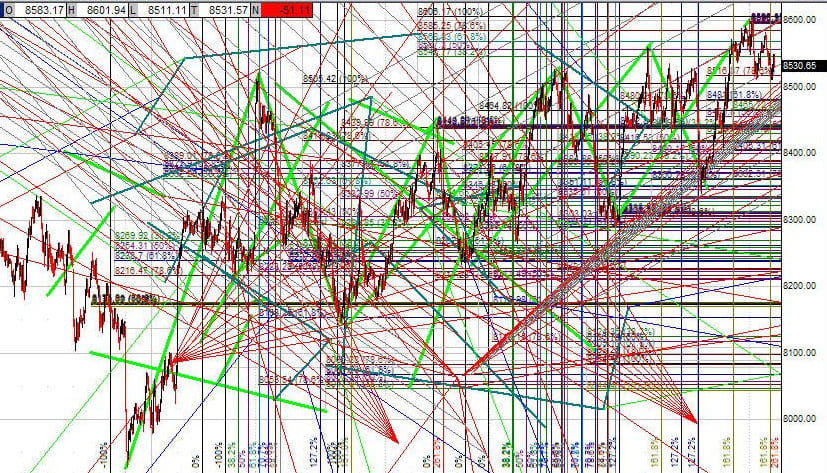

As opposed to this (what I refer to as indicator madness):

Ok, this one might be the other extreme. I’m not even sure I can still see the price on this! But you get the idea.

Another way to look at it is that price action does away with all the clutter that is usually associated with indicators. The only thing you’re left with is a clean, or “naked” chart. That doesn’t mean you can’t use a moving average or draw support and resistance lines. However, the movement of the price will always be paramount and it is that price movement that you’ll be able to read and understand soon enough.

Basics of price action trading

As we mentioned, price action trading revolves around only using the price of the security to make informed decisions on what the market might do. But that doesn’t mean we can’t look at it in different ways! The first step in price action trading is to familiarise yourself with candlesticks.

Candlesticks

Here are two examples of candlesticks.

The red one shows the price going down (and is said to be bearish) and the green one shows the price going up (and is said to be bullish). While the red and green colours are by no means required, it is common to show candlesticks like this as this makes it easy to recognise the direction of the market.

What makes candlesticks so different from let’s say line charts, is that each candlestick shows a wealth of information about what the price has done in a certain time period. Just from one candlestick, we can make up the open price, close price, highest price and lowest price. This makes candlesticks one of the most effective ways to display the historical and current price of a market.

If you want to know more about candlesticks, I would recommend that you pick up a copy of (Japanese Candlestick Charting Techniques by Steve Nison). Steve is regarded as one of the grandfathers of western candlestick analysis and his book contains a wealth of information on what it takes to use candlesticks in your trading.

Now that you know what a candlestick is, let’s move on to the good stuff: candlestick patterns.

Candlestick pattern analysis

Candlestick patterns are one of the pillars of price action trading. Basically, candlestick patterns are groups of one or more candlesticks that exhibit a specific pattern. Candlestick patterns are so powerful because they often convey what the market has done. This in turn gives us clues what the market might do.

To get you started, there is an overview of commonly used candlestick patterns (courtesy of Joe Marwood):

As you can see, some candlestick patterns are said to be bullish and others are said to be bearish. Even other candlestick patterns indicate indecision. Usually, candlestick patterns tell a story. They might show us that the sellers first tried to push the price down, grinding lower. All of a sudden though, buyers regained control and in an instant, pushed the price up with a force that is much stronger than what was seen before (three line strike).

It tells us who is in control, and therefore is a powerful way to analyse the market.

Chart pattern analysis

The next step in price action trading is to look at charts as a whole. While candlestick patterns can show us inflection points, it is useful to take a step back and look at the entire chart.

Trending and ranging markets

When we look at the entire chart, it will give us clues as to the direction of the market. Do we have a trending market? Is the market staying flat most of the time, or it is ranging between an upper and lower boundary? A useful way of determining the direction of the price is to look at the highs and the lows that the market is making:

On the left side, we can see that the price is making higher highs (H) and higher lows (L). The market is therefore said to be in an uptrend. On the other hand, if the price is making lower highs and lower lows, the market is said to be in a downtrend.

If the price stays between an upper boundary and lower boundary, the market is said to be ranging. It’s not making higher highs and higher lows or lower highs and lower lows. Instead, it is more or less going sideways:

Now let’s get into the nitty gritty of price action trading with why price action might not yet work for you.

Top 3 reasons why price action isn’t working for you

I often believe it’s useful to look at why something doesn’t work. You’ll get more out of looking at your losing trades than at your winning trades since you’ll be having a clearer picture of what went wrong. Using the same approach to price action, let’s have a look why you might be currently struggling with price action trading:

1. You can’t measure price action

Price action can’t be measured in absolute values. You can’t say price action is now at the 70 level, so it’s time to sell! Beginning traders feel more comfortable with something they can put a number on, which is why they avoid price action and go for the indicators.

Price action describes the market sentiment for a currency pair. It’s not measurable in one value, but instead tells a whole story about buyers and sellers and gives you a much more complete picture of the current market situation.

2. You ignore the context of price action

You might have read about price action patterns like a pin bar. A lot of traders usually forget to mention one thing though. Depending on where the pin bar shows up, the same pin bar can both be a sell signal and a buy signal. Even more, some pin bars should completely be ignored if they happen in the wrong place!

We’re going to cover the context of price action setups when we get to my top secrets, keep on reading!

3. You trade price action in isolation

Price action should be a tool in your trader’s toolbox. But that doesn’t mean it should be the only tool! While it is possible to purely focus on price action, years of trading have taught me that it is better to combine it with other types of market analysis. It will increase your win rate considerably. I will discuss this in my price action secrets below.

My 10 price action secrets

Through years of price action trading, I’ve found that some things work better than others. I’ve completely modelled my trading style to reflect this, but I realise it’s not always easy for beginning traders to pick up on those subtleties. That’s why I want to save you a lot of time and go over what I believe are the most important price action secrets you will want to know.

These are the tips that will take you from price action beginner to being able to employ a solid and profitable price action strategy.

1. Multi-candle patterns are more reliable

The more candles a specific pattern contains, the more reliable it usually is. 3 candle patterns are better than single candle patterns. 30 candle patterns are usually better than 3 candle patterns.

Here’s an example:

Patterns like head and shoulders, double and triple tops are among my favourites, exactly because of this reason. They consistently result in higher probability trades, which is what we’re all after. It doesn’t mean that a good pin bar setup won’t work, it just means there’s a higher probability of having these multi-candle setups resulting in a winning trade.

2. Wait for confirmation

Confirmation means that instead of entering when the pattern completes, it’s often helpful to see if the price will follow through. To make sure that I get confirmation, I enter just a little bit above or below the pattern, depending on which direction I suspect the price will go. This way, you can avoid fake-outs where price reverses on you, leaving the inexperienced traders in the cold.

Seasoned traders know to wait for confirmation.

Also don’t get into the habit of entering trades before the pattern completes. It’s tempting to want to enter when the last leg of a head and shoulders pattern is almost complete as you would get a better price, but it’s just as likely that the price reverses before the price action pattern completes, leaving you with a loss instead of the result you hoped for. Waiting for pattern completion shows patience, which is a personality trait every trader should have.

Here’s an example:

Here, we can see an uptrend where suddenly, price seems to stall a little bit. It consolidates sideways until quite a large pinbar shows up. Now you could do two things: jump in immediately or wait and put a sell stop a few pips below the low of that pinbar.

These are the candles that follow:

As you can see, price didn’t hesitate and made a move higher. The impatient trader would have opened the order and very likely have its stop loss hit for a loss. The pro price action trader however would find that his sell stop would have never been hit and didn’t have lost any money.

Now which scenario do you prefer?

3. Know where to place your stop loss

Knowing where to place an order is just the beginning. Where do you place your stop loss? Fixed pips stop loss levels are hardly a good approach since the market volatility can change and every trade should be looked at within the context of the recent market history. There are a few strategies to place stop losses like a boss, and I’m going to share them with you.

Stop loss above the price action

This is the easiest (and in many situations the best) option. When you see a price action pattern, you take the high of that pattern, add a few pips (± 5) and place your stop loss there. This is a good strategy because many times, the price will not go further than the high or low that the price action pattern created.

The drawback of this approach is that depending on the pattern, your stop loss might be quite large. A large stop loss means a smaller R:R, so you’re taking more risk to get the same reward. Nevertheless, in many cases, this is a valid approach. Have a look at this bearish engulfing bar, where you would place the stop loss a little bit above the pattern.

Stop loss half-way the pattern

When the pattern is so large that it’s realistically not possible to put your stop loss above the pattern, this could be another option.

It often happens with pin bars with a very long wick. It is riskier than our previous option though, since there is more of a possibility that the price will actually retest certain levels, as long as it stays within bounds of the pattern. But taking into account R:R, this can still be a good approach.

4. Always look for confluence

This is absolutely one of the most important secrets you have to know about. Confluence is everything.

So you’ve found a sweet price action setup. Great! Now make sure it has confluence, meaning that it coincides with other valid signals that support your trading idea. Here’s a triple top and previous high confluence:

These signals can come from a multitude of sources, but here are a few that I sometimes use in my trading:

- Price action pattern happens at a meaningful support or resistance zone

- Divergence on RSI

- The pattern happens at a fibonacci retracement level

- The pattern happens at a pivot point

- It’s a break and retest setup

- ……..

The very simple rule is: the more confluence you can have, the better the setup is.

5. Tell a story of what happened

Every chart tells a story. It might be a story of clear direction or a story of messy back-and-forth battling between buyers and sellers. In a similar way, we can talk about clean price action vs messy price action. It is up to the trader to find the story and better understand what the market might do.

Unclear story

From this chart snapshot, we can create our story:

The buyers were initially in control and pushed the price quite high. Eventually, they hit a resistance zone and had trouble keeping the price at this level. Sellers regained control and violently pushed price back down. But the buyers won’t just give up! In the second wave, they move the price back up until – you guessed it – sellers blocked their path and regained control.

This goes on for a couple of times and is characterised by lots of strong up and down moves, lots of candles with long wicks combined with candles with large bodies and – most importantly – a general lack of clear direction. You can define some resistance and support zones, but the price action is rather messy and it is not something I would trade.

Good story

Let’s go about creating our story again:

Clearly, in the left part of the chart snapshot, the buyers are in control. We see large green candles pushing upwards with very little counterweight from the sellers. There is a slight pause on the way up, this is what we would call a consolidation. The buyers catch a break, so to speak. After this consolidation period, we again see a strong push upwards. Candles are mostly defined by large bodies and relatively small wicks.

Now I want you to focus on the sequence of 4 candles at the top of the structure. At some point, we can see a large bullish candle, followed by a small bearish pin bar followed by a rather large indecision candle (the one with the long upper and lower wicks) and finally a strong bearish candle. This should already ring the alarm bell.

Let’s go through it step by step: the large bullish candle is a so-called exhaustion candle. The reason this candle is the largest of them all is that at this point, the most buyers finally are aware of this uptrend and so the most buyers are in the game. The imbalance between buyers and sellers is the largest here.

Next we see that at some price level, sellers start to push the price down, but don’t yet succeed (the bearish pin bar).

There are still too much buyers that believe this will go higher, so it takes some more time. The next candle is what you could call an indecision candle candle, but I would call it the squeeze candle. Buyers are “squeezed” to keep their position and a lot will sell at a loss.

At the same time, sellers see the price going down and are more convinced they are on the right side of the move. There is no victor yet and the battle continues until the last candle, where we see a strong move down and the sellers take control. The tide has turned and they will push the price further down.

What would you prefer to trade? The first or the second scenario?

I know what story gives me the most confidence on the direction of the price.

Clean price action and being able to tell a convincing story about what price is doing will help you in making better trading decisions. While it may take some time to be able to read charts like this, it is done purely by interpreting price action.

6. Find the major inflection points

Inflection points are areas that mark the beginning of a fundamentally different behaviour of the price. They are the big spikes indicating rejection of a certain price level, the turning points in the direction of the market. It’s characterised by a big concentration of buyers and/or sellers. It’s where the big moves happen. Inflection points often form a part of your support and resistance as well, and you will see that a lot of those inflection points regularly line up to be at the same price level.

These points (or areas) are important because there will be a lot of buyers and sellers looking at them. Lots of buyers and sellers will have orders close by that will trigger. Stop losses and take profits will be around these levels. It is therefore important that you keep an eye on these levels. But how do you find them?

Let’s look at an example:

Basically, all areas where one of the following happens:

- A major spike

- A lot of increased activity

- A major turning point in price direction

It takes some experience to know what the important inflection points on a chart are, but usually, the larger the spike or the stronger the move, the more important the inflection point will be. These points can line up with other inflection points to form support and resistance zones, which brings us to the next item.

7. Identify key support & resistance zones

Support and resistance (or S&R for short) are terms used to denote areas where price reverses at its lowest point (support) and highest point (resistance) on a chart. Often, these zones are “tested” multiple times as traders look for increased buyer and seller activity around these levels. It’s important to note that support and resistance are usually not thin lines, but rather zones. This example should make things clearer:

The stretched out green rectangles represent support and resistance zones. Support indicates a lower level and resistance indicates an upper level. The green arrows show where price approached a resistance zone and (sometimes sharply) reversed. The red arrows show where price approached a support zone and reversed. Also note that sometimes the same zone can be resistance but then become support after price has broken through it (and the other way around).

Trending support & resistance

Support and resistance levels do not have to be horizontal either. Here is an example of support and resistance in an uptrend:

As you can see, the lower and upper boundaries are here defined by a rising channel. At some moments, price protrudes the cannel but always comes back. Again, these boundaries are more like zones than specific lines (but it’s not easy in TradingView to draw rising zones ).

Dynamic support & resistance

Finally, support and resistance can also be defined by dynamic lines, for example using moving averages or Bollinger bands boundaries (see, it’s not forbidden to use indicators – just know when they’re useful).

Here’s an example of dynamic resistance (note that price can still pierce through it sometimes, it’s not an exact science):

Support and resistance are of importance since they are often areas of increased buyer and seller activity. Price is more likely to react to such levels, giving us opportunities to enter the market.

Market reaction to support and resistance levels

I’ve found that horizontal support and resistance lines are usually more reliable than trend lines and dynamic S&R, but this depends on the situation and the amount of times a specific support or resistance level has been tested.

On the one hand, the more times a level of support & resistance has been tested, the more people will have eyes on that level so it will hold more easily. On the other hand, you have to consider the amount of buyers and sellers for a certain level. Every time a specific level has been tested, less buyers and sellers will be left to keep the level intact for the next time. This means that after a few tests, price might eventually break through it after all.

All of these things should be considered when defining your support and resistance. The more you do it, the better you will get at it.

8. The best price action is clean to the left

When you look at a price action setup on a chart, you will find that the best setups are usually clean to the left. What I mean by that is that ideally, the candles that precede the price action setup haven’t been around the same price levels that your price action setup is in.

This chart shows a head and shoulders setup with a lot of “white” space to the left. For the past 30 or so candles, the market hasn’t touched the price levels the head and shoulders pattern is in. The reason professional traders prefer these kinds of charts is because when the price hasn’t been trading at the current levels for a while, it’s likely that there are less traders having pending orders on these levels, which in turn will make the price action pattern more meaningful.

9. Avoid price action in narrow ranges

Price action in narrow ranges is often less meaningful than when price makes a new high or low, or at least goes to a level that hasn’t been touched in a while. In narrow ranges, there is often too much buyer and seller activity going on to make some price action setup valid. This is similar to the previous point about having charts that are clean to the left of the price action, but expands on that.

A better approach could be to wait for a range breakout and look for price action setups there. A good way to measure if the price is in a narrow range is by using Bollinger bands. If the bands contract a lot, there is less and less volatility and price might be ranging. On the other hand, if the bands expand again, you will often see price trending or making bigger moves:

Also know that the longer price is in a narrow range, the more likely it is that price will be trending afterwards.

10. Context is everything

Depending on where a price action setup occurs, you should interpret it differently. The same pin bar could be bullish or bearish, depending if they show up at the bottom of a downtrend or top of an uptrend, respectively. Not all patterns are also worth taking if they are not preceded by the right price action and happen at the levels that are in one way or the other of significance. This significance usually comes from confluent signals, which is the topic of secret 10.

This next chart shows exactly what I mean. There are multiple pin bars on the way up, but they’re not really meaningful as they don’t occur at levels that are significant. It’s clear that every single one of the pin bars lacks follow through and instead of a reversal, price keeps grinding higher. Keep in mind that the context of price action is everything.

Conclusion

Employing price action strategies is one of the most fundamental and powerful ways for a trader to become profitable. At the same time, it’s often not well understood and there are a quite a few misconceptions about it. In this guide, I’ve exposed some of the secrets to make price action work for you, providing you with examples to get the most out of your journey into the price action trading world.

It might take some time to get used to, but I believe price action trading is one of the best ways to understand markets. This doesn’t even only apply to forex, but a trader who understands price action can apply this to all kinds of financial markets such as futures, stocks, commodities and more. It’s about describing and understanding what’s at the core of every market.

Good luck becoming a successful price action trader!