Trading is the hardest way to make easy money.

I love this quote.

If trading was easy, everyone would be doing it.

On Working Hard

Before I explain in detail how you could become a successful forex trader, check out this epic quote from world-class MMA fighter Conor McGregor:

“There’s not talent here, this is hard work.

This is an obsession.

Talent does not exist, we are all equals as human beings.

You could be anyone if you put in the time.

You will reach the top, and that’s that.

I am not talented, I am Obsessed.”

– Conor McGregor

Let that sink in for a moment. I’ll wait.

Unsurprisingly, traders have a lot in common with top athletes:

- We are battling everyone else every day in the hopes to come out on top.

- We are extremely competitive.

- We soon realise that WE are the biggest stumbling block in overcoming a challenge. Mental and emotional toughness is everything.

- It’s an obsession. We need hard work to even stand a chance to make it.

Everyone can become a successful forex trader.

But not everyone is prepared to put in the time. So the first piece of advice I can give you on how to make it as a trader is this:

Work hard. Don’t give up. Keep improving, keep practizing. Put in the time.

The Game Plan

Which then bears the question: how do I get started?

There’s no easy answer. There are many obstacles along the way you need to tackle. Even then, there’s no guarantee you’ll get there. But if you’re prepared to work hard, I do have a 10 step forex trader game plan that will set you up with the best possible chances of making it as a successful forex trader.

Let’s get started.

Step 1: The Reality Check

“The best way to end up with $1000 in forex is to start with $2000”

Yeah.

There are probably a thousand easier ways to make money than by trading forex: start a drop shipping business, invest in real estate, buy and sell on eBay, market the skills you already have, etc…

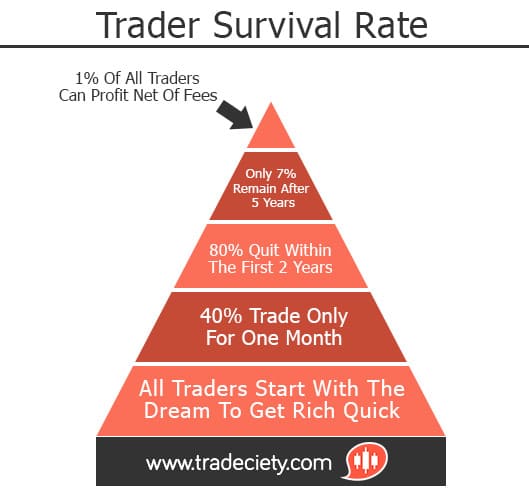

It’s not easy to make consistent profits trading forex. 70% of forex traders lose money, and this is a conservative estimate.

On the other hand, the potential profits – both in terms of freedom and financially – might just make it worth it.

Step 2: The Love

Have another look at the quote by McGregor.

“I am obsessed.”

Obsession. Passion.

You will need to have a (healthy) obsession with trading. You have to absolutely love trading. You have to love analysing the charts. Again and again and again.

Why?

Because research has shown that almost half of all traders will only trade for about a month. Even more: within two years, 80% of beginning traders will give up.

When that drawdown hits you the hardest, the love for trading is what will keep you going. When you have another losing month, the love for trading is what will keep you going. When you blow that account and wonder if you’re really made for this, the love for trading is what will keep you going. You just won’t give up.

Your love for trading is what gives you the willpower to persevere.

Step 3: The Grind

You might’ve picked up on this, but learning to trade isn’t a get rich quick scheme.

Forget the Instagram accounts with Rolexes and Lamborghini’s. Prepare to work.

Trading is a battle between you and the other market participants. And guess what: there’s only one way to come out on top:

- work smarter than the other traders

- work harder than the other traders

- don’t give up

Rinse and repeat. Don’t worry if you fail initially, that’s completely normal. It should actually motivate you to try again harder. Be realistic on your goals. Expect nothing in the first couple of months. Don’t expect too much in the first year. Make multi-year plans instead of browsing that luxury watch catalogue.

Embrace the grind.

Step 4: The Foundation

Everything before this step is just to get you in the right mindset, but THIS is where the real work starts. You need to get the basics right.

Build your foundation.

forex trading foundation

I know it sounds underwhelming, but focus on the process instead of the profits. You should take a broad overview approach of what trading forex actually is and the forex courses is excellent for this. Go through this entirely. This will probably take you a couple of weeks to a couple of months. Don’t rush this step!

Also get a demo account at a regulated broker. This allows you to get a feel of how trading actually works while getting familiar with the platform. I can recommend FxPro, I’ve been with these guys for a long time now and their spreads, support and reliability are top-notch.

The foundation stage is meant to get you up to speed with everything related to trading. It’s like a bird’s eye view on things like brokerages, the forex market itself, technical analysis, fundamental analysis, trading psychology and more. It won’t make you a specialist immediately but will set you up for continuing your path as a forex trader.

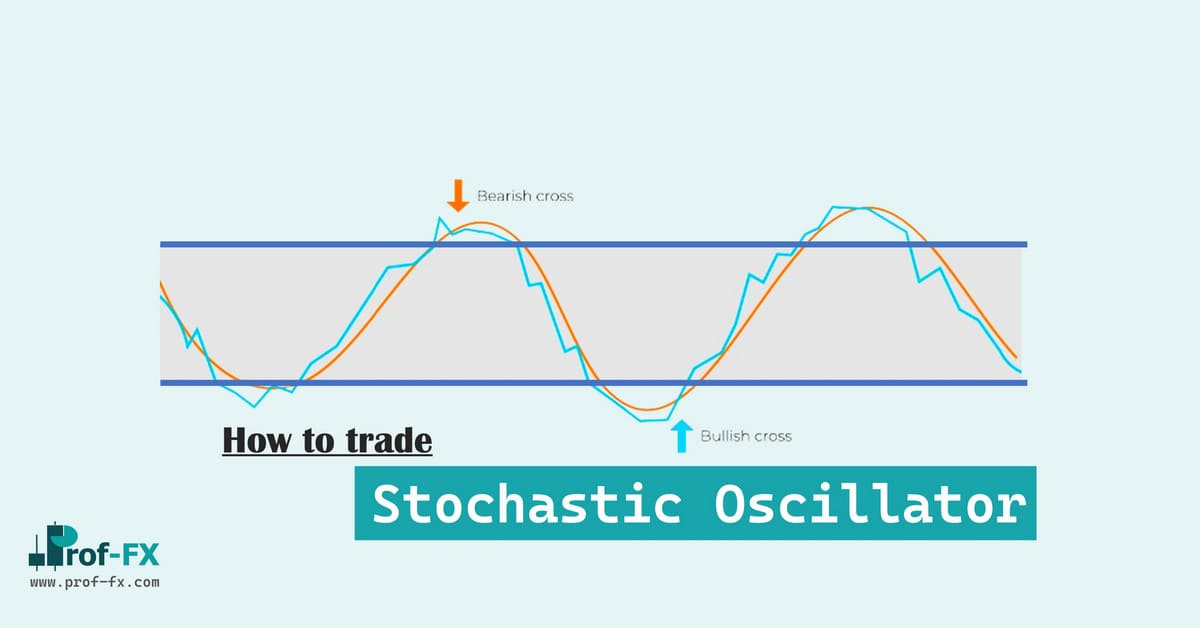

This is also the stage where you try our plenty of different indicators, platforms and trading strategies to see what suits you and find out how many different approaches to the market can actually make money.

Step 5: The Trading Plan

You will have read about trading plans in the Forex course already, but I want to make this a separate step.

Yes, it’s that important.

If you haven’t already, you should start creating your own trading plan. A trading plan defines everything that might be going on in your trading. It will be a place where you set goals, what your motivation is, what kind of trader you are, what type of trading style you’re comfortable with, what the exact rules are for your trading system and so on.

To give you an idea: my trading plan is a 30+ page document.

Your trading plan will obviously start out as a smaller document (1 or 2 pages is definitely better than nothing!), but it should also be a work in progress. Something you regularly revisit to keep it updated, revise and make changes.

A trading plan will give you the guidance you need to be a trader. It will prevent you to take a free-styling, random and impulsive approach to the market. Just the process of writing down how you think about your trading will give you new insights.

The difference between a successful trader and a losing trader is that losing traders lack structure. A trading plan provides that structure.

Step 6: The Accountability

Already more than halfway there! Sweet!

But we need some accountability. We need to know what works and what doesn’t. We need to track our performance in a way that we can review and adjust if needed.

We need a trading journal.

Journaling your trades is the process of writing down the stats of every trade you take in a journal. Entry price, exit price, date, time, stop loss and take profit target, setup type, time frame and so on. You will want to include a chart screenshot as well to be able to review it later on.

Journalling trades has many benefits:

- it allows you to take a more stats and data-driven approach instead of gut feeling ways of trading the market.

- it’s a logbook of your past trades, providing valuable statistics such as average win rate, the average risk to reward, Sharpe ratio and much more.

- it allows you to implement review routines (more on that later) and see what you did right and where you made mistakes. This feedback loop is immensely valuable.

- it holds yourself accountable.

Keeping a trading journal can be as simple as writing down your trades in a notebook, but it can just as well be something you save in Evernote, Excel or specialised trading journal software.

Find out what works for you and (most importantly) stick to it.

Step 7: The Structure

Right, you’re well on your way to becoming a successful trader. You know how to trade, you have a trading plan and trading journal, but now what?

You need some more structure in your trading. Build the habits of top traders. Want to know their secret?

Trading routines.

Routines are what will bring consistency to your trading life. And I don’t mean routine in the boring, creativity-depriving sense. Routines should be created to improve your life and enhance creative thinking.

I have weekend routines where I create my watch lists and do research, daily morning routines where I get ready for the trading day, end of day routines where I review my trading session and monthly routines where I do a performance review.

I’ve written in detail on how I structure my routines. Feel free to have a look and adapt them to your needs.

Step 8: The Mastery

Even though you have a good grasp on trading right now, you’ll soon realise that a professional trader is never done learning. Mastery of the trade will happen when you basically do two things:

- lots of practice

- continuous studies

If you haven’t done so already, you should keep learning about trading by regularly reading good books on forex trading. Improve your knowledge of price action patterns, technical and fundamental analysis, trading emotions, etc.

I’ve never encountered a professional trader who said that he/she was done learning about trading. You just keep improving, keep making fewer mistakes. Implement deliberate practice processes to fine-tune every aspect of your trading.

Become a master at what you do.

Step 9: The Psychology

Many traders who have been trying to become profitable but haven’t just yet reached that point, will find out that there is one uncertainty still remaining.

They have a well thought out trading plan, a trading strategy with a proven edge, the routines and structure to make it as a trader. All that’s left is…

Themselves.

Trading psychology and emotions might be the hardest thing to tackle in trading. It’s also one of the most important aspects of trading. You are the weakest link.

To understand more about trading psychology, you should read Trading in the Zone by Mark Douglas. It’s a classic on trading psychology and contains so much valuable information that you’ll probably be reading it many times during your trading career.

Also, subscribe to Brett Steenbarger’s blog and read his books. They’re incredibly valuable sources of trading psychology information.

You will learn more about yourself and your emotions during your trading life than ever before. Learn about how cognitive biases will influence your decision making. It will take some time to get the psychology right. Some traders never get it and keep lingering at this stage. Others will make it after they truly understand themselves.

This is often a hard nut to crack but it’s absolutely essential to be a successful trader.

Step 10: The Consistency

Impressive! If you made it this far, you’ve gotten further than most other traders. But this is not the time to slack. If you’re profitable by now, you will want to keep earning money.

You need consistency.

Keep working at executing your trading plan flawlessly. Often review your performance and if you see deviations, investigate why this is happening so you can potentially adjust. Keep on learning.

I’ve known quite a few traders who were making money for about 6 months, to suddenly start losing everything they had build up. Consistency is incredibly important so keep an eye on making sure you survive as a trader.

Conclusion

Will this 100% make you money? No. Hell no.

Most forex traders lose money. Then again, most forex traders don’t stick around long enough to know if they could’ve made it or not.

Will this set you up with the best chance of actually making it as a forex trader? Yes! And that’s basically all you can hope for. Work hard, don’t give up, have patience and you might make it. The freedom (both financially and in time) are so worth it.

Good luck with your journey!